The Latest Debt & Finance Blog

American seniors are fighting an ongoing battle as they try to cope with medical expenses on top of an already high cost of living. A recently published study has revealed…

The U.S. Department of Education is making debt-collection companies rich as it seeks to collect repayment of wayward student loans.

As millions of Americans struggle to keep up with monthly expenses in a tough economy, consumers in search of automobile loans are in for some good news: not only have…

A relationship between debt collectors and district attorneys that allows for the use of D.A. letterhead in the collections process shouldn’t be considered sound policy. It’s just too cozy.

America’s seniors were once considered among the most financially secure, with retirement at the top of the agenda. By the time people reached their 50s and 60s, Social Security and…

As a record number of borrowers default on their student loans, a new poll shows that those who haven’t paid off their loans want their lenders to forgive the debt.…

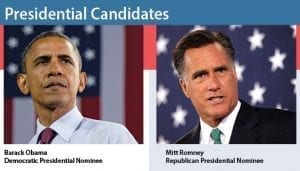

“It’s the economy, stupid,” was the mantra of Bill Clinton’s successful 1992 presidential campaign. At a time when the country was recovering from two-and-a-half quarters of recession and with unemployment…

It may seem ideal to refinance a mortgage or obtain a home equity line of credit (HELOC) at a time while interest rates are at an all-time low, but some…

Attention moms and dads: your teens are counting on you for more than a few bucks for a movie or some new clothes. They’re depending on you to pay for…

Good news is on the way for homeowners who held home equity lines of credit (HELOCs) with Citibank. Many customers’ HELOCs were suddenly suspended or canceled over the last four…

Sources:

- Mount Sinai Medical Center (2012, September 7). Health Care Spending in Last Five Years of Life Exceeds Total Assets for One Quarter of Medicare Population. Retrieved from http://www.newswise.com/articles/health-care-spending-in-last-five-years-of-life-exceeds-total-assets-for-one-quarter-of-medicare-population

- Brown, E.N. (2012, September 11). Medicare Patients Spend Thousands Out of Pocket at End of Life. AARP. Retrieved from http://blog.aarp.org/2012/09/11/medicare-patients-spend-thousands-out-of-pocket-at-end-of-life/

- Rosenberg, Y. (2012, September 10). Out-of-Pocket Medical Costs Threaten Seniors. The Fiscal Times. Retrieved from http://www.thefiscaltimes.com/Articles/2012/09/10/Out-of-Pocket-Medical-Costs-Threaten-Seniors.aspx#page1

- Silver, M. (2012, September 11). Study: Final Years Can Bankrupt Medicare Patients. Retrieved from http://www.theepochtimes.com/n2/united-states/study-final-years-can-bankrupt-medicare-patients-290903.html