Staff Writer

Katherine Pilnick

Katherine Pilnick is a writer for Debt.org. She educates readers about their various personal finance options. She is a graduate of New York University.

Imagine a financial service that could help you pay all your bills while at the same time fixing your credit history. That’s the promise of Western Sky Financial. Sound too…

As if tax season isn’t difficult enough, taxpayers must now be on alert for suspicious activity that could indicate that they are victims of tax-related identity theft. During last year’s…

Young Americans take on more credit card debt than previous generations did and are slower to repay it, according to research released last week. New evidence suggests that those…

Is college worth it? This is the question countless high schoolers ask themselves each year — especially as they apply to college this time of year — and the answer…

Gay Americans deserve a pat on the back, and not just for continuing to overcome added hardships and prejudices. Members of the LGBT community are also significantly better at managing…

Groupon executives decided Thursday to keep their CEO, Andrew Mason, but for how long? Amid rapid revenue declines in the daily deal industry, experts wonder if the fad has run…

Cyber Monday is the unofficial kickoff to the holiday shopping season. Acting as the online counterpart to Black Friday, it occurs the Monday after Thanksgiving. It is a day for…

There’s nothing in America quite like Black Friday. It’s an annual day of overabundant consumerism, a day of great deals and great mayhem. And it’s famous for holiday bargain shopping…

Mortgage refinancing is a great option for any homeowner who doesn’t have the lowest interest rate possible on his or her mortgage. It effectively creates a new mortgage at current…

The economy and President Barack Obama received some good news Friday, as the unemployment rate dipped below the 8 percent mark for the first time during Obama’s presidency. According to…

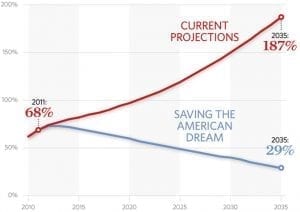

Wars throughout history have racked up debts for the countries involved. In the United States, conflicts tend to lead to the rise of both debt and taxes as the government…

There’s no denying that a nationwide consumer debt crisis continues to wreak havoc on middle- and lower-class households. But those on opposing sides of the political spectrum disagree about how…

Conservatives and liberals agree that high levels of national consumer debt continue to deter financial freedom and stifle the economy as a whole. But those with opposing political views disagree…