Medicare Cost & Medical Debt

Medicare, the federal government’s popular health insurance program for seniors (and younger people with permanent disabilities), covers nearly 60 million Americans, and adds more all the time: 10,000 baby boomers retire every day.

While this onslaught has trustees sweating the scheme’s viability — without changes, it will become insolvent in 2026 — it also puts significant pressure on current users to make wise choices. Fidelity Investments forecasts a healthy 65-year-old couple retiring today will need more than $275,000 to cover their medical expenses in retirement.

Medical debt could tarnish your golden years in a heartbeat.

Clearly, now more than ever, ensuring a healthy future — physically, emotionally, and fiscally — through retirement means maximizing your Medicare strategy.

Among the reasons for Medicare’s popularity is not just that it covers a tremendous range of medical services — which it does — but also that (long before Obamacare) it doesn’t exclude preexisting conditions. The downsides are, despite having kicked in 2.9 percent of every paycheck for most of your working life, it isn’t free, and it doesn’t cover everything.

If you’re about to wade in — and we all will, sooner or later — it’s helpful to know how Medicare is sectioned, and also how several key terms apply.

When created by Congress in 1965 as part of President Lyndon Johnson’s Great Society program, Medicare consisted of Parts A & B, also known as Original Medicare.

Medicare Part A is the major-medical portion of the program. It covers:

- Hospitalization

- Skilled nursing care

- Some home health care

Seniors who have paid into the program for at least 10 years, or 40 quarters (or whose spouses have), are eligible to enroll in Part A at zero cost.

Medicare Part B covers a wide range of services, including:

- Outpatient services

- Doctor visits

- Lab tests

- Mental health

- Preventive care

- Some clinical trials

- Physical and occupational therapies

- Certain supplies and medically necessary durable equipment, such as wheelchairs, walkers, monitors, commode chairs, hospital beds, and articulating mattresses.

» Learn More: Financial Assistance for Mental Health

Medicare Part B is optional, but unlike later additions to the program, enrollees have to decline coverage. For instance, if you’re 65 but still working for a company with a group insurance plan, you probably will want to decline Part B.

Over the years, Congress expanded Medicare, creating these add-ons:

- Part C, an attempt to control soaring costs, established the Medicare Advantage plan, introducing private managed care, some of which include prescription drug coverage. You must be enrolled in Original Medicare before you can add Medicare Advantage.

- Part D, the prescription drug coverage plan.

- Medigap, which allows enrollees to purchase additional insurance to plug holes in Medicare A & B coverage. Those gaps can be substantial. Medigap policies can be purchased from private insurers in your state.

Understanding Key Terms

Among the keys to making the right combination of Medicare options work best for you is having a good grasp of common insurance terms. That’s right. Just because you won’t be going to your company’s open enrollment seminars anymore doesn’t mean you can forget what is meant by premiums, deductibles, copays, and so on.

- Premium: The amount you pay each month for Medicare coverage. Part B, Medicare Advantage, Part D, and/or Medigap all can require a monthly payment. In some cases, people without a work history, may be charged a premium for Part A.

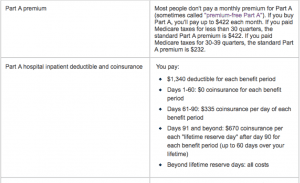

- Deductible: The amount you must spend before Medicare begins to pay. In 2018, a patient enduring a hospital stay would have to pay $1,340 before Medicare kicks in.

- Copayments, or coinsurance: Also known as cost-sharing, a copayment is an out-of-pocket expense for a covered service or drug. Copayments can be stubborn, continuing to reach into your pocket even when you have met your annual deductible on such things as prescription drugs.

All of these costs tend to be standardized for covered services under Original Medicare (Parts A & B). Costs for Medicare Advantage and Part D Prescription Drug Plan tend to vary by plan.

While the terms and definitions remain the same, premium and deductible amounts are changeable year by year. Medicare Parts A & B rates for the following year, published by the Centers for Medicare & Medicaid Services, or CMS, usually emerge in the middle of October or November.

Medicare Part D Prescription Drug Plan and Medicare Advantage premium and deductible rates are published each fall for the following year by Medicare-approved private insurance companies. People enrolled in Part D and/or Medicare Advantage receive a document called an Annual Notice of Change.

As you weigh the benefits and costs of Medicare Part C and Medigap plans, you will want to become familiar with Original Medicare’s annual and lifetime limits. Some Medicare Advantage and Medigap plans extend those limits; others eliminate them altogether.

Medicare Enrollment Periods

Before you can take advantage of all Medicare offers, you must enroll. Let’s start at the top: The go-to agency to get you signed up is the Social Security Administration.

Those receiving retirement benefits from Social Security before they turn 65 don’t need to do anything; they’ll automatically be registered for Original Medicare starting on the first day of the month of their 65th birthday.

Those postponing retirement or, at any rate, delaying tapping their Social Security nest egg, must initiate the process on their own. Social Security will not call, or email, to ask them to sign up.

The window for the initial enrollment period opens three months before your 65th birthday arrives, and extends for four months beyond that magical date. Enrollment can be achieved online, in person, or via written forms sent through the mail.

Whatever else they have to say about Medicare, all the experts agree on this: Do your research early. Do not wait until the window is on its way down either to examine your options, or attempt to contact Social Security; you might choose poorly, and you might get shut out.

Medigap coverage carries a separate six-month initial signup period. Coverage is guaranteed during that period, but once it expires, you can be denied based on underwriting costs.

If, somehow, you’re reading this more than four months after your 65th birthday and you’re not working for an employer who provides health insurance (more about that below), your world is not ending.

Seniors who botch initial enrollment have an opportunity to redeem themselves during a general enrollment period each year from Jan. 1 to March 31. Beware: Coverage for general enrollees does not begin until July 1.

Worse, latecomers almost certainly will feel the pain of procrastinator enrollment penalties for Part B and Part D, roughly 10% for every dozen months you delayed, or 1% per month, respectively.

If you’re working and get health insurance through your employer, congratulations. We not only admire your energy, you’re off the Medicare signup hook. You can ignore the 65th birthday window. Instead, you have eight months after your retirement date to enroll. No penalties will have accrued, and Medigap coverage — should you choose it — is guaranteed.

Premium costs

As mentioned above, people who have a Medicare tax history of 10 years, or 40 quarters, enroll in Medicare Part A without charge. Spouses can qualify under their partners’ work histories. Others may pay as much as $422 a month in 2018.

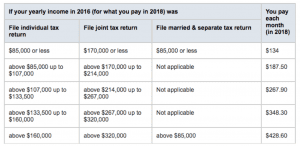

Pinpointing Medicare Part B premiums is tricky. The final figure depends on assorted variables, including whether you’re enrolling for the first time in 2018; whether you opted out during your Initial Enrollment Period (or if you dropped it, and are opting back in); and your household income (as reported on your tax return two years ago).

The ballpark figure for new Part B enrollees is $134 a month, but can soar as high as $428.60 if your income in 2016 was above $160,000 (individual filer) or $320,000 (joint return).

The premium cost of supplemental insurance — Medicare Advantage, Medigap — pivots on the amount of coverage you want to purchase, and the company from which you purchase it. Shop hard to get the best deal.

Part D prescription drug coverage varies depending on the drugs you use; the plan you choose; whether you go to a pharmacy in your plan’s network; whether the drugs you use are on your plan’s formulary (or drug list); and whether you qualify for Extra Help (see below).

Costs for Part A Enrollees

Here are the 2018 costs for Part A enrollees. Remember, these can change year over year.

Costs for Part B Enrollees

Here’s how Medicare explains your 2018 Part B out-of-pocket costs:

- You generally pay 20% of the Medicare-approved amount for the doctor or other health care provider’s services, and the Part B deductible applies.

- For all other services, you also generally pay a copayment for each service you get in an outpatient hospital setting. You may pay more for services you get in a hospital outpatient setting than you would pay for the same care in a doctor’s office.

- For some screenings and preventive services, coinsurance, copayments, and the Part B deductible don’t apply (so you pay nothing).

Medicare Part C (Medicare Advantage) Costs

Explore your options before committing to a Medicare Advantage plan. Generally, the average monthly MA plan premium in 2018 is about $30, but depending on the plan and your needs, the premium can range from $0 to more than $200.

These charges would be in addition to your Part B premium. On the upside, some Medicare Advantage plans pay a portion of your Part B premium. Check it out.

While you’re shopping, investigate what plans include prescription drug coverage, which ones have annual deductibles, what sort of copayments the plans require, and what the plans’ out-of-pocket maximums are.

The primary Medicare Advantage plans are:

- Health Maintenance Organization (HMO). These tend to be the lowest costs options, but they also are the most restrictive. You’ll need a primary care physician and, in most cases, a referral to see a specialist, who most likely will have to be within the plan’s network. Failure to follow the plan’s rules for services could result in the patient having to pay the full costs of care.

- Preferred Provider Organization (PPO). While the premium on a PPO tends to be higher than the HMO option, it allows greater flexibility. You can go to any doctor or hospital, but you’ll pay less if you see providers within the plan’s network. You probably won’t need a referral for a specialist, although specialists outside the network will cost more.

- Private Fee-for-Service (PFFS) allows you to choose family practitioners and specialists; however, not all Medicare providers accept the plan. Know up front whether the doctors you prefer will let you use it.

- Special Needs Plans (SNPs) — as you might expect — are available for people with special needs, such as a disabling chronic condition, and/or who live in a nursing home or similar facility.

- HMO Point-of-Service plans allow the patient to go to out-of-network providers, but at a higher out-of-pocket cost.

- Medical Savings Account (MSA) plans include high-deductible programs and a bank account into which Medicare deposits money each year to spend against your health-care needs. Generally healthy Medicare enrollees, or those with backstop insurance from their former employer(s), might take a hard look at MSAs. Otherwise, it’s a serious dice roll.

Medicare Part D: Prescription Drug Coverage

Added by lawmakers in 2006, Part D Prescription Drug Coverage has been a go-to program for Medicare enrollees hoping to limit their risks and control their costs.

Part D plans, offered exclusively by private companies, tailor plans to meet the needs of consumers. Nearly all the plans have monthly premiums; many — but not all — have annual deductibles. And each tends to have a customized list of covered drugs.

There’s also the Part D coverage gap, informally known as “the doughnut hole.” In 2018, the hole opens after you and your plan have paid $3,750 for prescription drugs, and ends after you have reached $5,000. In short, the doughnut hole is an incentive for you to limit your demand for prescription drugs.

One little-known option: Ask your pharmacist about the cash price for the drugs you’re taking. A study reported in the March edition of the Journal of the American Medical Association found that, nearly 25% of the time in 2013, a patient’s copayment was higher than the cash price.

You would think your pharmacist might mention when cash prices are lower than copayments, but, no. In a perverse twist, most drug companies prohibit pharmacies from alerting you when the cash price for a drug is lower. If you ask, however, the pharmacist is obliged to disclose the information.

So: Always ask. Every. Last. Time. You won’t be any worse off if the answer is no, and you’ll postpone the doughnut hole experience if the pharmacist answers in the affirmative.

Now, about those Part D premiums. While companies set their rates, Medicare limits the surcharge available to them, based on income. Here’s a quick look:

Medigap and Retiree Coverage

We discussed Medigap fairly extensively above. The nutshell version: Available through private insurance companies, Medigap policies help cover costs that Medicare doesn’t, including copays and deductibles. Some Medigap policies also step in when annual or lifetime Original Medicare caps have been reached.

The premiums for Medigap fluctuate based on the level of coverage in the policy, the enrollee’s age, and location.

Seniors with retiree coverage from a past employer still must enroll in Medicare Parts A & B, because Medicare is the primary insurer. The retiree’s private health plan becomes the secondary insurer, filling gaps in coverage.

Seniors should compare program costs to determine the most advantageous combination of plans. Occasionally, retiree insurance combined with Original Medicare might result in higher out-of-pocket expenses than Medicare plus a carefully crafted Medigap policy.

Get Help Paying Medicare Costs

A variety of ways exist to help alleviate the cost of health care in your golden years; medicare.gov, the official U.S. government site for Medicare, highlights these:

Medicaid, a joint federal/state program that helps with medical costs for some people with limited income and resources.

State Medicare Savings Programs (MSP) help pay premiums, deductibles, coinsurance/copayments, prescription drug coverage costs.

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health-care needs in their communities.

If you meet certain income and resource limits, you may qualify for help from Medicare to pay costs of Medicare prescription drug coverage (Part D).

If you live in any of the U.S. territories — Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa — and have limited income and resources, you may qualify for additional help.

Supplemental Security Income (SSI) is a monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits should not be confused with Social Security retirement or disability benefits.

Solidify Your Financial Footing

While Medicare has vastly improved seniors’ ability to afford medical care, we’ve seen how premiums, deductibles, copays, and add-on policies can strain retirees’ budgets.

To keep up with their medical bills, especially if they’re in financial trouble, seniors may need the services of a debt management professional who offers debt settlement or debt consolidation. In a worst-case scenario, deeply indebted seniors might need to consider bankruptcy.

Seniors with other assets, such a house with substantial equity, could consider a home-equity loan, a home-equity line of credit (HELOC), or a reverse mortgage. Each scheme would allow the homeowner to tap his or her equity while retaining ownership and tackling medical costs.

Sources:

- Van de Water, P. (2018, July 3) Medicare Is Not “Bankrupt.” Retrieved from https://www.cbpp.org/research/health/medicare-is-not-bankrupt.

- Gleckman, H. (2018, June 6) No, Medicare Won’t Go Broke In 2026. Yes, It Will Cost A Lot More Money. Retrieved from https://www.forbes.com/sites/howardgleckman/2018/06/06/no-medicare-wont-go-broke-in-2026-yes-it-will-cost-a-lot-more-money/#520549647eb1.

- Landau, J. (2017, Oct. 3) Health-care dilemma: 10,000 boomers retiring each day. Retrieved from https://www.cnbc.com/2017/10/03/health-care-dilemma-10000-boomers-retiring-each-day.html.

- Grant, K. (2017, Aug. 24) Expect to spend more on health care in retirement — even if you’re well. Retrieved from https://www.cnbc.com/2017/08/24/average-couple-will-spend-275000-on-health-care-in-retirement.html

- NA (NA) Durable medical equipment (DME) coverage. Retrieved from https://www.medicare.gov/coverage/durable-medical-equipment-coverage.html.

- NA (NA) What is Medicare Gap? Retrieved from https://www.mymedicarematters.org/coverage/medigap/?SID=5b4fe9f20bd17824.

- NA (NA) Make Sense of Medicare Costs. Retrieved from https://www.mymedicarematters.org/costs/.

- Armbrecht, K. (2017, Oct. 16) 6 Tips For Enrolling In Medicare. Retrieved from https://www.forbes.com/sites/nextavenue/2017/10/16/6-tips-for-enrolling-in-medicare/#4b2cc304a777.

- Graham, J. (2016, Oct. 27) How Not to Mess Up Your Medicare Enrollment. Retrieved from http://time.com/money/4548153/medicare-enrollment-tips/.

- Mott, S. (2018, July 6) Medicare Premiums and Deductibles for 2018. Retrieved from https://medicare.com/about-medicare/medicare-premiums-deductibles-2018/.

- NA (NA) What Are Medicare Part C Costs? Retrieved from https://www.mymedicarematters.org/costs/part-c/.

- Olmos, M. (2017, Jan. 25) The Different Types of Medicare Advantage Plans. Retrieved from https://medicare.com/medicare-advantage/the-different-types-of-medicare-advantage-plans/.

- Caplinger, D. (2017, Nov. 24) Here's What Medicare Part D Costs and Covers in 2018. Retrieved from https://www.fool.com/retirement/2017/11/24/heres-what-medicare-part-d-costs-and-covers-in-201.aspx.

- Cross, J. (2018, Feb. 27) Medicare Supplement (Medigap) Plan Comparison Chart. https://medicare.com/medicare-supplement/medigap-plan-benefits-chart/.

- Jaffe, S. (2018, May 30) Looking For Lower Medicare Drug Costs? Ask Your Pharmacist For The Cash Price. Retrieved from https://www.washingtonpost.com/national/health-science/looking-for-lower-medicare-drug-costs-ask-your-pharmacist-for-the-cash-price/2018/05/30/1759d1da-63ea-11e8-81ca-bb14593acaa6_story.html?utm_term=.6d05c24b71fd.

- me

- You will need Adobe Reader to view the PDF Download Adobe Reader