Financial Aid Process

Home > Students & Debt >

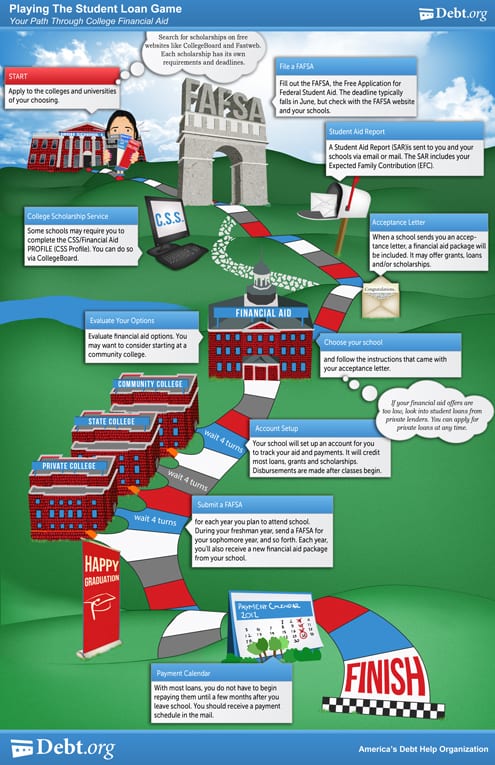

The college financial aid process is long and it’s boring, but it can be a long and boring road to riches.

The federal government handed out $125.7 billion in financial aid in 2016 and it could have been more. A lot more.

A study by NerdWallet found that over 1.4 million high school graduates never completed the Free Application for Federal Student Aid (FAFSA) process, losing out on $2.7 billion in federal grant money.

That’s $2.7 billion in free money, gone to waste!

You’ve already made one great financial decision by going to college. A bachelor’s degree will net you $24,193 more in salary per year than a high school diploma, which comes out to about $1.1 million more over the course of your working lifetime.

Make another great financial decision and complete the student aid process, starting with filling out the FAFSA and applying for some of that unclaimed federal grant money.

You don’t want to be one of the 1.3 million college graduates that leave school in debt because the only financial aid they received were student loans.

What Is Financial Aid?

There are three types of financial aid: scholarships, grants and loans. Each can help you pay for college, but scholarships and grants, which can be merit or need-based, are the preferred route because you don’t have to repay them.

Student loans, on the other hand, can be had by just about anyone, but must be repaid within 10-25 years of graduation, depending on the repayment plan you choose after leaving school.

Each type of financial aid follows its own application and offer process. Federal student aid is easy to apply for, and by far the most common type of aid. Almost 90% of students attending nonprofit colleges received federal aid.

Private lenders and donors have separate procedures and application processes. You’ll receive awards and offers through your college, and private aid will come through the lenders and donors.

Finding and Applying for Financial Aid

It’s never too early to begin looking for scholarships. You can start your search on free websites like Fastweb and the College Board, where you can find everything from a $2,000 grant for demonstrating a talent in duck calling to $1,500 for explaining why it’s better to be left-handed.

You may also be eligible for scholarships and grants specific to your college or university, and some high schools even award them to college-bound students.

When you find a scholarship for which you qualify, its application instructions should be included. For scholarships, you may need to write an essay. Be sure to pay attention to all the rules and guidelines, as well as any deadlines.

For grants and loans, the application process is easier. Most grants and loans simply require you to complete the FAFSA and the college’s take it from there. Each school has a specific amount of grant money it awards and uses their own discretion in dividing it among applicants.

The FAFSA is used to determine your financial need and can qualify you for need-based loans and grants. Originally created to qualify individuals for federal aid only, the FAFSA is now used to determine most need-based aid, federal and others.

Students — and their parents — should aim to complete the FAFSA during the student’s senior year in high school, but after their college applications are completed. Be aware that it has a deadline in the spring that can change year to year. You must complete a FAFSA each year you plan to attend college and ask for financial aid.

There will be an area on the FAFSA where you can indicate which schools you’ve applied to. Each school on your list will receive a copy of your FAFSA results once they are completed by the government.

What you need to fill out a FAFSA:

- Create an FSA ID (username and password)

- Social Security number

- Alien Registration number (for Green Card holders)

- Federal tax information or tax returns (can link to tax info through IRS Data Retrieval Tool)

- Cash, savings and checking account balances

- Investments other than the home in which you live

You may also choose to complete a CSS/Financial Aid PROFILE (CSS Profile) via the College Board. Like the FAFSA, the PROFILE provides a way to determine financial need and connect students to aid opportunities.

Unlike FAFSA, there is a fee. College Board charges $25 for the first college and $16 for each additional college. Applicants from low-income families can qualify for a fee waiver.

Student Aid Report

If you are awarded a scholarship, the scholarship donor will alert you separately. The method depends on who is funding the scholarship and how you applied. For example, you may receive a notice that you’ve been chosen to receive a scholarship with your acceptance letter from a college.

If you filled out the FAFSA, you’ll receive a Student Aid Report (SAR) after the federal government processes your paperwork. This can take three to five days if you submitted the document electronically and provide a valid email address. If you submit a paper form FAFSA and do not provide an email address, it could take three weeks for you to receive your SAR by postal mail.

Your SAR includes a summary of all the information you provided. It also includes your Expected Family Contribution (EFC), which estimates how much your family is able to pay for your expenses that year.

Copies of your SAR will be sent to every school you listed on your FAFSA. Each school that accepts you will use your SAR and EFC information to create a personalized financial aid package. Schools may also use the CSS Profile or another means of determining financial aid eligibility.

Financial Aid Packages

You’ll receive a financial aid package along with any acceptance letter you receive from a college.

The goal of any financial aid package is to make sure your financial needs for college are met through a combination of family contribution, merit-based scholarships, student loans and any other financial aid means. Each financial aid package you receive will be different, although your EFC should remain fairly constant.

Financial aid packages vary by school for two main reasons:

- Each college has a different cost of attendance. What may be enough financial aid at one school may not cover the costs of another.

- Each college has different funds to pull from. Although all federal financial aid is funded by the U.S. government, it is often distributed at the discretion of each school. That means each school has a different pool of funds available, and a different amount it can offer per student.

If Aid is too Low

First, try to negotiate. Remember that financial aid packages are offers, and offers can be negotiated. Colleges want top students to boost their ranking and many of them use financial aid to lure students.

Once you have received all of your award letters contact your school of choice. You want to see if they will match an offer you received from a comparable school.

Most schools have an appeals process with two avenues to negotiate:

Merit negotiations – Contact the admissions office by sending an email or letter with an explanation of why you should receive more. Include a better offer from another school to see if they will match it. Give it a week and then call to follow up.

Need-based negotiations – Contact the financial aid office and ask about the appeals process. More than likely they will refer you to some financial forms to fill out and mail in. Be prepared to outline and support the circumstances that changed your financial standing.

Once you decide on a school to attend, follow that school’s instructions to reply and accept the offer. You may find that your financial aid offer does not cover costs to your satisfaction. This may be because your EFC was higher than you expected.

In this situation, your best option is to turn to private lenders for additional student loans or apply for private scholarships. Private lenders typically rely on your credit history or that of your parents to determine if you are eligible for a loan and, if so, to determine your lending terms.

Sources:

- V. Simons and A. Helhoski (2016 January 27) How Students Missed Out on $2.7 Billion in Free FAFSA College Aid. Retrieved from https://www.nerdwallet.com/l/nerdwallet-guide-to-fafsa

- Student Loan Hero (2017 August 7) A Look at the Shocking Student Loan Debt Statistics for 2017. Retrieved from https://studentloanhero.com/student-loan-debt-statistics/

- NA. ND. Fast Facts. Retrieved from https://nces.ed.gov/fastfacts/display.asp?id=31

- Bureau of Labor Statistics (2017 April 20) Unemployment Rates and Earnings by Educational Attainment, 2016. Retrieved from https://www.bls.gov/emp/ep_chart_001.htm

- Trip to College (2012). Paying for College: A Personal Plan to Find the Resources.

- College Scholarships (2012). Education Grant Benefits and Opportunities. Retrieved from http://www.collegescholarships.org/grants/

- You will need Adobe Reader to view the PDF Download Adobe Reader