Breaking Down Your FICO Score

You may know your credit score, but understanding how you are graded can be a tool to help you raise your score in the future, and avoid repeating the mistakes you made in the past.

A FICO credit score is named after the Fair Isaac Corporation, which provides the algorithm for assigning this value. It is a numerical estimate of a consumer’s ability to repay borrowed in full and on time. The score is based on six main categories related to credit use.

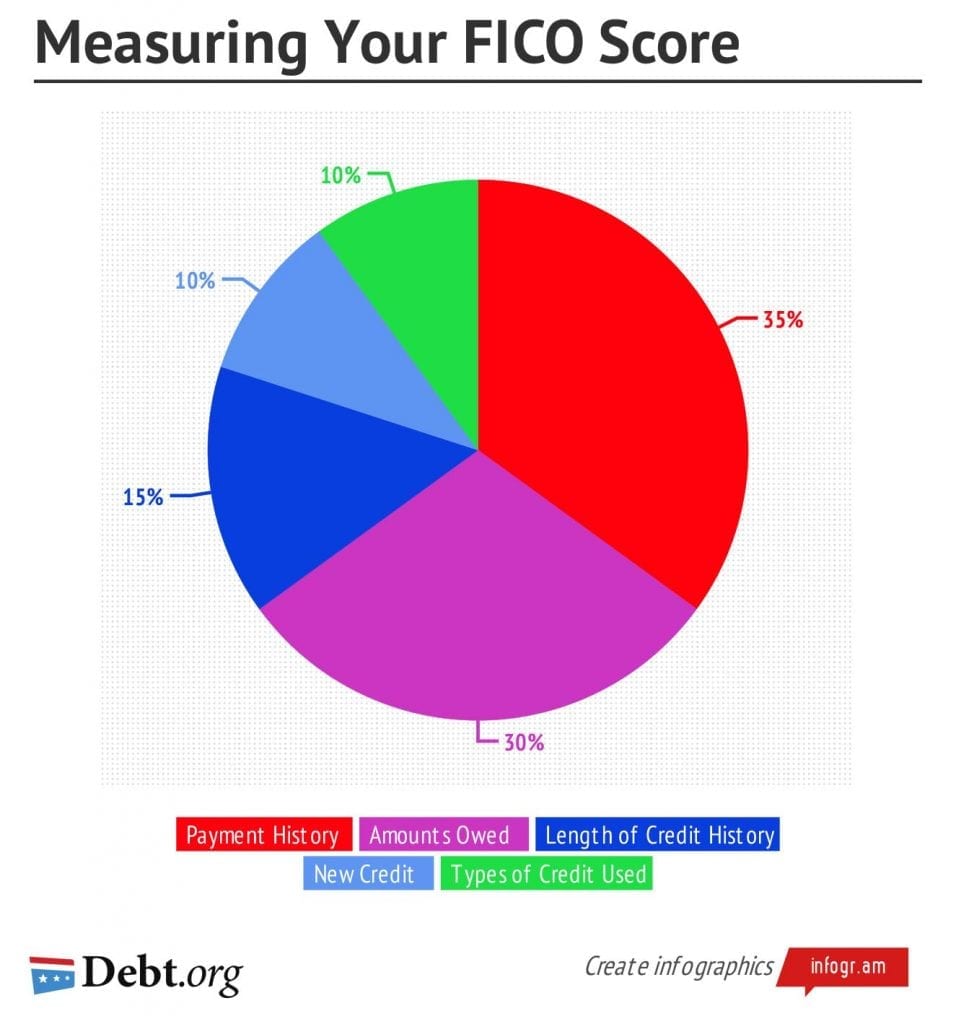

Payment history and amounts owed weigh the heaviest in the categories that determine your FICO score.

Based on the percentages provided by myFICO, the consumer division of the Fair Isaac Corporation, and the scale of 300-850, here is the range of points within each category, how your activity is measured and how you can improve each individual category.

If you don’t have a credit score, open a credit card account and start building your credit score using credit cards. Just be sure to manage your credit responsibly and pay it off a the end of each month.

Payment History

Payment history is worth about 298 points of your total credit score. It shows if you’ve made late payments or skipped payments, as far as 7 to 10 years ago. This category relates details on accounts sent to collections, bankruptcies, liens, judgments and other delinquencies. Positive information in this category will related to the number and type of accounts that are paid on time.

Examples of accounts reflected in this category include:

- Retail cards

- Installment loans

- Student loans

- Auto loans

- Mortgage loans

You may be able to improve your credit score based on payment history by catching up on missed payments and making an effort to pay bills before they are due. If you cannot handle payments, contact your creditors to negotiate an affordable plan.

Amounts Owed

Using some of your available credit regularly does not have a negative impact on its own. However, using all the credit you have available –maxing out your credit cards—will have a negative impact. Amounts owed makes up about 250 points of your total credit score. The financial term which describes this is credit utilization, based around the concept of evaluating the proportion of credit that is in use compared to how much is available. Lenders view a low amount of available credit as a possible risk.

When you close an old account you reduce the amount of credit you have available, which can cause your score to drop.

Boost your credit utilization ratio by making more than the minimum payment you owe and reducing the total balance on your cards. It may help to set your own limit — one that’s well below the credit maximum — and avoid going over that.

Length of Credit History

Lenders want to see that you have been able to manage credit use for a significant amount of time. Length of credit history is about 128 points of your total credit score. It reflects when your oldest account was opened, when your most recent account was opened and when your last activities on all accounts occurred.

Part of building your credit history length is simply opening an account and waiting. After six months, your most recent accounts should be included in your credit report. Make sure to use your new and old accounts from time to time, and pay them off right away.

New Credit

Lenders have noticed that consumers that open several credit accounts in a short period of time present a greater risk. Some consumers with newer accounts, especially if there are multiple new accounts, will have fewer points here. New credit makes up about 85 points of your total credit score. This category reflects how many times you have recently applied for credit and the balance of recent accounts.

As you consider opening new accounts, make sure to avoid applying for multiple loans or credit cards that you will not qualify for. Also, applying for credit frequently, instead of occasionally, can damage your score.

Protect your new credit by ensuring you responsibly make payments on new accounts and only use a portion of the available credit.

Type of Credit

While owning every type of credit card is not a necessity, it can be beneficial to have a few different kinds of credit available, demonstrating that you can use credit wisely for multiple purposes. This category makes up about 85 points of your credit score. Types of credit include retail accounts, installment loans, traditional credit cards and mortgages.

Remember, diversifying credit types should not mean having some accounts you pay off regularly, while others go ignored. Approach all accounts responsibly. If you choose to close an account, understand that it will not be removed from your history.

Making Sense of Your Credit Score

All of the major credit bureaus, Transunion, Experian and Equifax, use the formula created by the Fair Isaac Corporation to calculate FICO scores. However, each credit bureau will show a different FICO score for you.

Because of certain factors, like lenders reporting your credit incidents to only one bureau and bureaus weighing actions slightly differently, your score will likely differ from bureau to bureau. In addition, the scores can change daily, as credit bureaus may receive new information from creditors at any time.

Credit scores between bureaus often vary as much as 40 points. If there is a larger discrepancy between scores, you should obtain a copy of your credit report to make sure that it is up to date and accurate.

Lenders may also look at your Vantage score, which is also sold by the credit bureaus and uses a differently formula to provide credit risk information on a scale from 501 to 990.