How to Build Credit with a Credit Card

Key Takeaways

- Having a credit score and credit history is important to building a financial foundation.

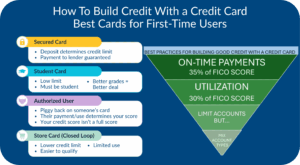

- Secured, student, and store credit cards are good ways to begin to build credit.

- Making on-time payments, not maxing out cards, and having a good credit mix are key to building credit.

- A nonprofit credit counselor can help you get started by reviewing your finances, helping with a budget, and discussion options, free of charge.

One of the fastest, most efficient ways to build and improve your credit score is to use your first credit card properly, regularly, and responsibly. That means making your payments on time and, if you can do it, in full. And that means staying as far away as possible from your card’s credit limit despite using the card consistently.

Do all that, and your credit score, as well as your finances in general, will grow into the healthy state you want to take with you into your future. Even when you’re starting from scratch.

How to Start Building Credit with a Credit Card

Having a credit history and credit score are important for a lot of reasons. The obvious one is that it gives you more access to important credit like auto loans and a mortgage. But your credit standing is also often considered for things like renting property, insurance premiums and renting a car. The better credit risk you look, the more likely you are to get good terms.

Starting with a credit card is the best way to begin to build credit. It ticks the boxes that many lenders look for, and also the ones that calculate a credit score – particularly payment history and how much you depend on credit.

To build credit with a credit card, you actually have to have a credit card. But, of course, credit card companies like to see an established positive credit history before approving an account. The lender wants to have confidence that a new cardholder will make payments on time.

The good news is that there are several types of credit cards you can be approved for without a credit history – secured cards, student cards, and store cards can all do the job. Your job is to make payments on time and use the card responsibly, both of which will go a long way toward building good credit.

Make sure any credit-builder you use reports to the three credit bureaus – TransUnion, Experian, and Equifax. The credit bureaus use the information about your payments and card habits to determine your credit score. The information reported, if you use the cards responsibly, will improve your credit score and give you a foundation to build on.

Secured Credit Cards

Secured cards allow someone with no credit history, or a spotty one, to build good credit with no risk to the lender. A secured credit card requires the cardholder to put down a deposit, usually $200-$2,500, that also determines the credit limit. If you don’t make payments, the credit card company keeps the deposit.

If you do make on-time payments, your credit score will improve and you’ll build a credit history. Make sure the card company reports your information to the three major credit bureaus before applying. Look for a card with no annual fee, as well as one that offers the option of returning your deposit and upgrading to an unsecured card once you’ve proven you can make payments on time. The unsecured card will be the next step to building stronger credit.

Student Credit Cards

A student card usually has easier qualifying standards and a lower limit than a traditional credit card. Your credit limit will increase as you make on-time payments. To qualify, you have to be a college or graduate student and be at least 18 years old. You also have to show an income source. If you’re under 21, you may have to find someone to co-sign, or show evidence that your independent income is enough to make payments.

Store Credit Cards

Most major retailers have their own credit card that can be used in their stores and on their websites. These are closed-loop cards, which can only be used with that retailer. They are usually easier to qualify for than general credit cards, and have lower credit limits and fewer fees. Shop around for one with a low interest rate. It’s a good idea to get one at a store where you can buy things that you need, but won’t be tempted to overspend.

Many retailers also have open-loop cards, which can be used anywhere, but still have discounts and rewards for purchases made at the issuing store. These may be harder to qualify for without a credit history.

Become an Authorized User

If you can’t get approved for a credit card, being added to someone else’s card as an authorized user can help establish your credit score, though that one account may not be enough for many lenders to approve you for credit. As an authorized user, you can use the card to make purchases, but the main card-holder makes the payments. If the card-holder makes on-time payments, and the card isn’t over-used, their credit score will be positive, and so will yours. If not, then it won’t.

Be sure that the card company reports authorized users to the credit bureaus. Some don’t. The main card-holder then adds you to the card as an authorized user, and you’ll be issued a duplicate card with your name on it in most cases. Since the card-holder makes the payments, it takes good communication and cooperation between both of you to make this successful. It’s also a good test run to determine whether you can use a card responsibly and pay what you owe without the hit to your credit if you can’t. Add other credit accounts to your credit report before being removed as an authorized user, or it will have a negative impact on your credit score.

Credit-Building Apps

There has been a big uptick in digital credit-building tools for people with no credit. Some of these apps report things like rent and utility payments to the credit bureaus (with the cooperation of your landlord or utility service). Some offer credit-building loans, usually secured loans that are similar to secured credit cards. Most of them can help build credit, but keep an eye on fees and other costs. A credit card, which ticks most of the boxes necessary for a credit score, is still considered the most reliable way to build credit fast.

Best Ways to Use a Credit Card to Build Credit

A credit card is a great way to build a credit score, but it can also do serious damage to your financial future if it isn’t used wisely. A credit card is a contract between you and the creditor. They are lending you money to buy things. It’s up to you to pay them back according to the agreement. A history of late payments, overusing cards, and too much dependence on revolving credit, is a signal to potential lenders that you aren’t a good risk for them to lend their money to.

Your credit-worthiness, based on those factors, is shown to lenders in the form of a credit score. There is a huge variety of types of credit scores. A FICO score, which ranges from 300 to 850, is used for 90% of consumer credit lending. VantageScore is the other major consumer lending credit score, but there are also several others. All use the same type of information in their calculations, and while some is given different weight, on-time payment and credit utilization are always at the top.

Best practices to make sure your credit card builds a credit history and good credit score include:

1. Always Pay On Time

Payment history accounts for 35% of a FICO score – 297.5 of an 850 score – so payment consistency is a huge factor in how high your FICO score will be. It’s also the most heavily weighted factor for a VantageScore. It makes sense – a measure of your ability to pay on time is the best way a lender can determine how you’ll make payments in the future. No matter what else you do – making payments on-time is crucial to building and maintaining good credit.

2. Keep Your Credit Utilization Low

Credit utilization is the second most important factor in determining your FICO score, accounting for 30%, and is also heavily weighted in other scoring calculations. Credit utilization is how high your balance owed is compared to what your limit is. For instance, if your credit card has a limit of $1,000, and you have a $250 balance, you’ve used 25% of your available credit, for a credit utilization of 25%. If you have more than one card, the total you have available and the total balances are added together. For instance, let’s say you have a second card with a $2,000 limit, and your balance is $1,000. That means your total use is $1,250 out of $3,000, for 41.6% credit utilization.

Lenders like to see utilization of 30% or less. The higher it is, the more negatively it impacts your credit score. It can also mean higher interest and less favorable terms on future cards and loans.

3. Limit New Credit Applications

Once you have a credit score and credit history, you can apply for other credit accounts and loans. Don’t overdo it, though. Every time you apply for new credit, a hard inquiry, or hard pull, is performed. That means the creditor is taking a look at your credit history. Every time it happens, it appears on your credit report and stays there for two years. Too many in a short amount of time, and it indicates to lenders that you’re in danger of over-extending financially. Each hard inquiry can mean a 5-10 point hit to your credit score. While there are benefits to adding to your credit mix, do it with moderation and planning.

If you’re approved for the accounts that you’re applying for, too many new ones at once will also have a negative impact on your credit score – counting for 10%. New accounts will also bring down your length of credit history average, which counts for 15% of your FICO score.

4. Build a Good Credit Mix

It’s still important to add to your credit mix. When you do, consider other types of credit besides credit cards. Lenders like to see a variety of credit sources, because it indicates you can responsibly deal with other types of borrowing and are not relying on credit cards. A good mix counts for 10% of your FICO score.

If you’re just building credit, a personal loan from a credit union or other lender that offers small, low-interest loans, can help improve your credit score over time. Use the money in a way that will help you financially – paying for school or school supplies, car repairs, home repairs or weatherization, or even to pay off the balance of your credit card, will make borrowing a win-win.

5. Use Your Credit Card Regularly

Building credit is a balancing act between being active with your card, making sure you can afford payments, and not having too high a balance. On the other hand, since on-time payments are so important, it’s important to have something to make payments on. The best approach is to make small purchases regularly that you can afford to pay off at the end of the month.

6. Keep Your Accounts Open

The length of time your credit accounts are open makes up 15% of your FICO score. The scoring structure averages the age of your accounts. Every time you open a new one, the average goes down. So, even if you aren’t using a card often, your score benefits from each month the credit bureaus see it as active. Don’t shut down old accounts, especially if they aren’t charging an annual fee. Since the length of all accounts are averages, it’s another reason to be thoughtful about opening new accounts and taking on new credit.

7. Treat Your Credit Card Like a Debit Card

Credit card vs. debit card: What’s the difference? In a lot of cases, it’s the difference between financial stability or overwhelming debt. With a debit card, you can only use money that you have in your account. With a credit card, you’re borrowing money, sometimes at high interest, with an obligation to pay it back. The more you charge, the harder it can be to pay it back. If you let balances build, it’ll cost you a lot more than what you originally paid. If you treat your credit card like a debit card, keeping track of what you spend and only spending what you can afford, you’re much more likely to stay on top of your finances and make on-time payments. Set a budget and stick to it, so you’re planning every expenditure. That way, you won’t be surprised by bills you can’t pay.

Benefits of Credit Cards

When used responsibly, credit cards can have big benefits.

Some of the benefits of credit cards are:

- Fraud protection means they’re safer to use than a debit card

- Convenient way to pay for a big purchase

- Can be used to buy online or where cash isn’t accepted.

- Hotels, airlines, rental car companies often require a card

- Can pay for unexpected expenses or an emergency

How Long Does It Take to Build Credit with a Credit Card?

Building good credit is a marathon, not a sprint. The longer your credit history, particularly if you make on-time payments consistently and don’t overuse credit, the better your score will be. The length of your credit history, if you’ve been responsible, will lead to lower interest rates and better terms when you borrow. This will make a big difference when it comes to big, essential needs like auto loans and mortgages. It also helps show financial responsibility to landlords, utility companies, insurance companies, and a host of other businesses and services that will check your credit to see what kind of financial risk you are.

If you’re just starting out building credit, the general timeline is:

1-6 months. Some credit scores, like VantageScore, will appear when your account is first reported to the credit bureaus.

6 months – A FICO score isn’t calculated until there is at least one account that’s six months old or more.

1-2 years – Every lender is different, but many require a credit history of at least a year, and many require two years, before a borrower qualifies for a loan.

2 years-forever. The longer you grow a strong credit history, with on-time payments, a good mix of accounts, and low utilization, the higher your credit score will be and the more financial options you will have.

Speak to a Credit Counselor About Using a Credit Card to Build Credit

Building credit may feel overwhelming, but you don’t have to do it alone. Asking for expert advice about the best ways to use a credit card to begin to build your credit is a great first step. There is help available from professionals at nonprofit credit counseling agencies, free of charge.

Credit counseling will help you review all your options by walking you through the ins-and-outs of different credit card options and the impact they will have on your credit score. The counselor will tailor their advice to fit your unique financial circumstances. They’ll suggest credit solutions, even if those circumstances include bad credit history and/or debt.

The bottom line is, don’t be afraid to call a nonprofit credit counseling agency to initiate the conversation. It can be the beginning of a beautiful friendship between you and your credit, soon and for the rest of your life.

You won’t regret it.

Sources:

- NA, (2024, September 13) What are some ways to start or rebuild a good credit history? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-are-some-ways-to-start-or-rebuild-a-good-credit-history-en-2155/

- NA (2024, December 12) How Do I Get and Keep a Good Credit Score? Retrieved from https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/

- NA (2024, September 13) Do store credit cards build credit? Retrieved from https://www.americanexpress.com/en-us/credit-cards/credit-intel/how-store-credit-cards-affect-your-credit-score/

- NA (2024, July 9) Do authorized users build credit? Retrieved from https://www.capitalone.com/learn-grow/money-management/do-authorized-users-build-credit/

- Redlin, P. (2025, June 2) Best Credit-Building Apps July 2025. Retrieved from https://www.edvisors.com/money-management/credit/best-credit-building-apps/

- NA (ND) How to Rebuild Your Credit. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_how-to-rebuild-your-credit.pdf

- NA (2023, February 8) How Long Does it Take to Build Credit? Retrieved from https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-build-credit/

- NA (ND) How to Build Credit. Retrieved from https://www.myfico.com/credit-education/credit-scores/how-to-build-credit#how-long-does-it-take-to-build-credit-history