Staff Writer

Max Fay

Max Fay has been writing about personal finance for Debt.org for the past five years. His expertise is in student loans, credit cards and mortgages. Max inherited a genetic predisposition to being tight with his money and free with financial advice. He was published in every major newspaper in Florida while working his way through Florida State University.

Foreclosure is one of the scariest financial challenges a homeowner can face. Losing your home means not just finding somewhere new to live, but also dealing with years of damaged…

The very fact that an individual is considering bankruptcy speaks to the difficulty in paying an attorney to help you file. If you’re in debt, does it make more sense…

Declaring bankruptcy is a big deal. The long-term damage it can do to your credit is such that bankruptcy only should be considered as a last resort, after credit counseling,…

Bankruptcy does not preclude anyone from buying a home, but it will take some serious work to get it done. Buying a home after bankruptcy depends on taking the right…

After the unpleasantness of bankruptcy proceedings is finally over, a sobering question may arise: What if I need to buy a car? There’s good news: It’s possible, especially if the…

Though there is room to debate the wisdom of filing for bankruptcy without your spouse, there is no law preventing a husband or wife from doing so. There are several…

Bankruptcy laws exist to provide a fresh financial start for people whose debt has become unmanageable. The debt may be from unforeseen circumstances, like medical bills or a job loss,…

Bankruptcy is a scary word that gets even scarier when you realize it’s going to cost you money you don’t have to get rid of the debts you do have.…

The oxymoron of bankruptcy is that a person deep in debt has to pay for the way to get out of debt. Government thinking, no? Yes, Chapter 7 bankruptcy can give you…

Debt consolidation through a refinanced mortgage is an attractive and beneficial way to pay off loans and eliminate high-interest debt. The prime factor for qualifying for debt consolidation refinancing is…

A payday loan can seem like a helping hand for those in quick need of cash to make ends meet. And given the number of payday loans taken out annually,…

If you’re looking for a way out of debt, chances are good you’ve come across the term “debt consolidation” and chances are just as good that everyone you talk to…

Teens see a driver’s license as a ticket to adulthood and adventure while their parents likely view it as a torpedo aimed at their household budget. The cost of adding…

Another month, another budget-crippling cable bill. When will it ever stop? The average cable bill is now $103.15 a month and is increasing year after year, despite more competition. What…

We can drive a car at 16, vote at 18, drink at 21, but until recently, we couldn’t rent a car until 25. Fortunately for the 25-and-under crowd, those rules…

We’ve heard all about your roommate nightmares. There’s the guy who walks around in his boxers eating all your leftovers, or the girl blasting Beyoncé at two in the morning…

Anyone who’s been in deep credit card debt knows that paying it off can be a long and stressful process, so it’s natural to wish for a quick fix. But…

Credit cards are a hot topic for Millennials. Half of the world tells us that credit cards are pure evil and the other half constantly brags about the “rewards” they…

A pink slip can be a traumatic experience but losing your employer-provided health insurance is nothing short of devastating. Since the coronavirus pandemic erupted in early 2020, tens of millions…

When the federal government handed out the first student loans in 1958, the message was simple: This money is to be used for education purposes, meaning tuition, books, fees, supplies…

Complete reliance on a laptop is one of the most common shared experiences among college students. You stay up late in the library, pounding on your keyboard and thinking to…

The federal bankruptcy system could see a drastic overhaul if a bill proposed by two Congressional Democrats becomes law. Rep. Jerry Nadler (D-N.Y.) and Sen. Elizabeth Warren (D-Ma.) say their…

If the size and complexity of your debt is bothering you, trust your instincts. Yes, you ought to consider consolidating that debt to make it more manageable. There is good…

The good news – if it can be called that – is there is no law against filing for bankruptcy twice, thrice or however many times you reach a point of…

If you’re a Texas first-time homebuyer, the process can seem overwhelming and intimidating. The challenges include a tight supply of homes and rising prices. But there’s help available that can…

Medical treatment gets people well. Medical bills make a lot of people sick. Healthcare costs in the U.S. are skyrocketing toward $4 trillion a year. Paying them is so difficult…

While much of the way forward remains murky, many small businesses were casualties of the 2020 coronavirus pandemic and more may fade away as the pandemic rolls into its third year.…

Bankruptcy is a legal process for individuals and businesses that can’t pay their debt. After filing, the court decides how much debt, if any, will be forgiven and how the…

When in need of quick cash to pay a bill or an emergency expense, a payday loan is often the easiest place to turn. It is also often the most…

Money troubles weigh heavily on military families. In fact, service members and spouses in a 2018 Blue Star Families survey ranked financial stress as a bigger concern than deployment, moving,…

People normally enter credit counseling when they are struggling with burdensome debt and need help working through it. In most cases, buying a home and taking on a mortgage isn’t…

Advertiser Disclosure Debt.org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services…

Traditionally, few achievements are more cherished in America than homeownership. We regard the home as castle, shrine, gathering place, and refuge, the bricks, mortar, and timber symbol of our liberty…

For generations, the 30-year fixed rate mortgage has reigned, like hot dogs and apple pie, as America’s gold standard. We love it for its predictability and affordability. A 30-year fixed…

Congratulations, you’ve bought a timeshare! If you are like a lot of people, your next move will be trying to get rid of it. Buyer’s remorse grips a lot of…

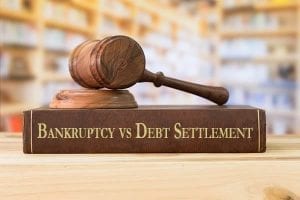

Anyone struggling with overwhelming debt — and many Americans are, with household debt hitting a record $18.39 trillion — surely must be contemplating a surefire way to relieve the sense…

Credit counseling agencies are a dime a dozen, but choosing the right agency can feel like a game of Russian Roulette. How do you know who to trust? What…

Medical emergencies, job losses and even divorces can turn a solid financial base into mush, forcing you to make gut-wrenching decisions that come with lasting consequences. Get to know your…

Just making a phone call or clicking a link online to a credit counseling or credit repair company should make you feel like you’re one step closer to putting your…

A college education doesn’t come cheap, as 44 million Americans can attest. Collectively, they have borrowed $1.75 trillion to score a diploma, and paying it back hasn’t been easy. About…

About Social Security Disability Denial If you’ve suffered a catastrophic accident, or endured a harrowing diagnosis, you may be eligible for Social Security Disability benefits. Tread carefully. The path to…

If you’re having difficulty managing credit card debt, you may want to consider consolidation. The main benefits of credit card consolidation are reduced interest rates and fewer accounts to manage.…

Credit cards are amazingly handy tools. They allow you to pay for practically anything in an instant, no checks or cash required, at least not at that moment. Bills do…

Teaching is both a profession and a calling. What it is not is especially lucrative. Few occupations make such a huge impact for so little financial gain. Fortunately, options are…

Health is priceless and illness can be very expensive. For a significant number of Americans, the cost of a medical emergency can put family finances in intensive care even after…

Think again if you believe having health insurance provides immunity from medical debt. Good insurance will cover a large portion of the cost for medical treatment and prescriptions, but almost…

Taking out a debt consolidation loan is a good strategy for consumers trying to eliminate high interest credit card debt, but there is a hitch to this plan if you start with…

The cost of caring for a child with special needs can be frightening. It costs well over $300,000, at current prices, to raise a child from the time he or…

Cancer’s devastation is nearly boundless. It threatens lives, terrifies families and drains savings, undermining even the best laid financial plans. But there’s help beyond medicine for those who receive this…

*If you’re currently experiencing a mental health crisis or if you’re considering harming yourself or others, please get help immediately. You can call the free and confidential National Suicide Prevention…

Considering that more than one-third of people in the U.S. are living paycheck to paycheck with no real emergency fund or savings, it’s not surprising that many of us find…

Need some extra cash? Home equity loans are a convenient, low-cost way to borrow large sums at favorable rates. Home equity loans for debt consolidation will have a much lower…

Why Consolidate Student Loans? It simplifies repayment and could save you money. It is quite common for people with student loans to deal with 10-12 lending institutions, which means 10-12…

If this headline piqued your interest, then maybe the interest rate on your student loan has peaked too. There’s a few things you can do send your student loan interest…

Four of the more popular online courses are HomeTrek, eHomeAmerica, Framework and Alliance Credit Counseling. Here’s a look at the costs and strengths of each program. Updated: April 16, 2021…

Slightly more than one million taxpayers faced an Internal Revenue Service (IRS) audit of their individual tax return in 2017, but that accounted for less than 1% of all returns.…

Credit counseling is designed to help consumers avoid bankruptcy and escape living paycheck-to-paycheck. Credit counselors offer advice on budgeting, managing money and other basics of finance. They assist people unsure…

Consumers are $500 million deeper in debt with student loans than credit cards. So, where are all the breathless commercials and billboards for relief from academic loans like you see…

Medical school is expensive. To put it in perspective, 2017 graduates with medical school debt owed an average of $192,000, which happens to be the same cost as buying a…

The lives of American consumers are increasingly like open books: vulnerable to sophisticated cyber-snoopers capable of discovering a great deal about how people save and spend. Yet even as the…

AVERAGE DAILY HOSPITAL COSTS $0 AVERAGE ANNUAL NURSING HOME RATE $0 MONEY SPENT ON HEALTH CARE IN 2016 $0 Trillion Medical Bill Debt & Costs The average U.S. consumer spends…

Jason Thomas went to law school for the money. The student loans never bothered him because he was going to graduate, start practicing law and make a whole lot of…

If you plan to participate meaningfully in the U.S. economy, it is vital to examine your credit report every year, and understand everything in it. A credit report is a…

The Consumer Financial Protection Bureau (CFPB) is an independent agency under the Federal Reserve System. It was created in 2010 to protect and educate consumers about their dealings with financial…

If you don’t qualify for a traditional credit card because you have no credit history, secured credit cards are a great way to get your toes wet and learn how…

The debt collection industry generates $11 billion a year from the 70 million Americans who haven’t or can’t pay their bills. Debt collectors get most of their revenue from people…

The term “charge-off” means the business that gave you the loan, typically a card company or retailer, has written off the amount you owe as uncollectible, closed your account, and…

Wage garnishment is a subject people want to avoid talking about, but if your wages are being garnished that is exactly what you should be talking about. Wage garnishment is…

Student loans are meant to help individuals reach their higher education goals. Because of this, they typically carry lower interest rates than other types of loans and debts. Still, your…

Move over 401(k) and health insurance plans, there’s a new company benefit tailored to the millennial workforce. The “Student Loan Repayment Benefit” is the name, and it is being offered…

About Debt.org We are a team of financial experts dedicated to helping people understand and overcome their debt. Who We Are Debt.org is America’s Debt Help Organization, serving the public…

College is often the first time students manage their own money, and learning how to budget early can mean the difference between graduating debt-free or drowning in credit card bills.…

Everyone knows the price tag for college rises every year, but even soaring tuition costs can’t keep up with the skyrocketing price of college textbooks. According to data from the…

In truth, landing a mortgage with the best interest rate isn’t all that tricky and shouldn’t be scary. But it is complicated, painstaking, serious business. After all, closing on a…

While banks and other lenders have the right and responsibility to gauge the financial fitness of any person that applies for a loan, several federal laws prohibit them from engaging…

The college financial aid process is long and it’s boring, but it can be a long and boring road to riches. The federal government handed out $125.7 billion in financial…

Merit-based scholarships could be the most misunderstood aspect of college financial aid, based on the common misconceptions that: Only straight-A students qualify Only a few of the straight-A students actually get…

Unsecured debt is any debt that is not tied to an asset, like a home or automobile. This most commonly means credit card debt, but can also refer to items…

Need-based scholarships and grants are exactly what their title indicates: money for students with a financial need. More than 85% of college students receive some form of financial aid so there is…

When an 18 year old is concerned about budgeting, you know the cost of college tuition is getting out of hand. A new survey conducted by the Princeton Review says…

For many college graduates, finding a way to pay off student loans is just as difficult as finding a job right out of school. The average amount that borrowers owed…

Gambling is essentially anything that starts with the phrase “I bet…” And you can bet America loves to gamble. About 75% of adults in the U.S. – that’s 194 million…

Paying back student loans has become a challenge for more and more Americans each year. The cost of college has increased more than 135%, or about 2.3 times, between 1963…

If you’re one of over 40 million Americans who’s ever had a federal student loan or student aid, you may be at risk of identity theft or other security threats…

You don’t have to catch the virus to get harmed by COVID-19. As soon as the pandemic hit, scams arose to take advantage of people’s fears. In 2020, Americans have…

The gap between the presidential candidates on tax programs is Grand Canyon-esque. And that may understate it. President Donald Trump wants to continue the 2017 tax cut, which his campaign…

Many American businesses are disregarding President Trump’s order allowing them to temporarily stop withholding Social Security taxes from their employees’ paychecks. The plan, they say, is confusing and won’t produce…

If you’re considering a consolidation loan to sweep away credit card debt and lower your monthly interest payments, do it! There couldn’t be a better time. All you need is…

If you’ve lost your job due to the coronavirus crisis, your unemployment benefits are likely to decrease very soon. It’s just a question of how much. That will be decided…

“You deserve hazard pay for that job!” All of us probably have either said that or someone said it to us, and it’s almost always a tongue-in-cheek expression of sympathy…

President Trump’s latest budget proposal to Congress calls, once again, for the elimination of the Public Service Loan Forgiveness (PSLF) program. This is the second time Trump has recommended eliminating…

In the words of rapper/philosopher Jay Z: “You can’t knock the hustle.” Millennials are having to hustle to pay their student loan debt. Over 44 million American have student loan…

Data shows that homeownership among millennials is down, but that doesn’t mean they aren’t interested in buying a home. In the last two decades, homeownership in the U.S. has declined…

You’re a college student, and life feels grand. You have your classes picked out for next semester, and you’ve signed a lease through next year. Everything is falling into place.…

I thought we could avoid it. I promoted alternatives. But it was inevitable. My daughter asked me to throw her a Frozen birthday party, like the half dozen we’d already…