Update on Biden’s Student Loan Forgiveness Plan

The Biden Student Loan Forgiveness Plan was rejected by the Supreme Court. The Biden administration is working to find an acceptable replacement.

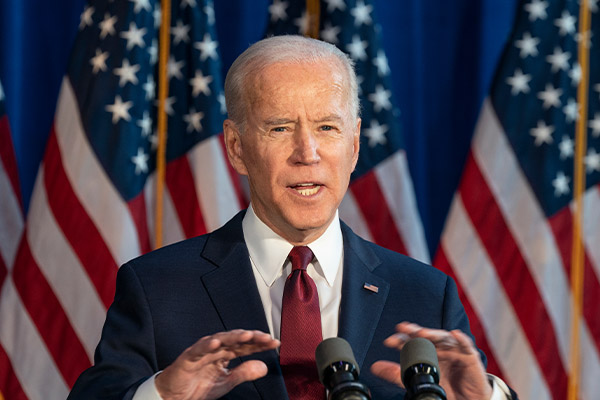

The Supreme Court ruled June 29 that President Joe Biden did not have the authority to erase hundreds of billions of dollars in student loan debt, effectively ending the Biden Student Loan Forgiveness Program

The 6-3 decision sided with the six states who argued that the President had overstepped his authority to cancel an estimated $400 billion in repayment for federal student loans.

Student loan payments will resume in October. Interest on student loans, which has been halted for three years because of the COVID-19 pandemic, will be applied starting Sept. 1.

Read on for more information on upcoming student loan due dates and new repayment guidelines.

Will Student Loans Be Canceled?

The Supreme Court’s ruling wiped out the Biden Student Loan Forgiveness Program, which would have canceled $10,000 of debt for nearly all the 44 million borrowers who took out federal student loans,

In response, the Secretary of Education has begun work on regulations that would open a new path to debt relief, using the Secretary’s authority under the 1965 Higher Education Act.

The Department of Education has finalized what it calls “the most affordable repayment plan ever created,” ensuring that borrowers will have immediate access to this plan this summer, before loan payments are due. Many borrowers will not have to make monthly payments under this plan. Those that do, will save more than $1,000 a year.

The Department of Education is instituting a 12-month “on-ramp” for repayment, running from Oct. 1, 2023, to Sept. 30, 2024. Borrowers who miss monthly payments during this period are not considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies.

» Learn More: When Will Student Loan Payments Resume?

Biden’s New Plan for Student Loan Relief

The Biden administration is moving forward with the Saving on A Valuable Education (SAVE) plan that aims to provide millions of Americans with sought-after relief.

This income-driven repayment plan is designed to cut borrowers’ monthly payments in half, allow many borrowers to make $0 monthly payments, save all other borrowers at least $1,000 per year and ensure borrowers don’t see their balances grow from unpaid interest.

More detail on how Biden’s new SAVE plan will affect borrowers:

- For undergraduate loans, cut in half the amount of discretionary income that borrowers have to pay each month from 10% to 5%.

- Raise the amount of income that is considered non-discretionary income and therefore is protected from repayment. This guarantees that no borrower earning under 225% of the federal poverty level — about the annual equivalent of a $15-an-hour wage for a single borrower — will have to make a monthly payment under this plan.

- Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less. The Department estimates that this reform will allow nearly all community college borrowers to be debt-free within 10 years.

- Not charge borrowers with unpaid monthly interest, so that unlike other existing income-driven repayment plans, no borrower’s loan balance will grow as long as they make their monthly payments, even when that monthly payment is $0 because their income is low.

What Was in the Original Biden Student Loan Forgiveness Plan?

While President Biden is putting forward a plan to make student loans more affordable than ever, many aspects of the original plan (such as student loan forgiveness) will be scrapped. Below we will go over the details of the original student loan forgiveness plan proposed by the Biden administration.

How Much Was Being Forgiven?

The amount of debt that would have been forgiven in the Biden Student Loan Forgiveness program was a maximum of $10,000 unless you received a Pell Grant during your time in college. If you did, you could have received up to $20,000 in loan forgiveness, provided your income during the pandemic was less than $125,000 or, if you were married and filing jointly, less than $250,000.

What Were the Eligibility Requirements?

- Your student loans would have had to come from a federal lender.

- The loan or loans you used to finance your education must have been obtained before June 30, 2022.

- If you filed your taxes as an individual, your adjusted gross income would have had to be lower than $125,000. If you filed as a married couple or as a head of household, your adjusted gross income would have had to be less than $250,000.

- Most federal student loans were eligible for forgiveness as long as they were taken out in pursuit of an undergraduate, graduate, or professional degree. It didn’t matter if you didn’t finish the degree; you would have still qualified for relief.

What Types of Student Loans Were Being Forgiven?

There were four types of federal student loans being considered for forgiveness through the program.

The four types were:

- William D. Ford Federal Direct Loan Program loans.

- Federal Family Education Loan (FFEL) Program loans held by the Department of Education or in default at a guaranty agency.

- Federal Perkins Loan Program loans held by the Department of Education.

- Defaulted loans, including Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS, and Perkins loans held by the Department of Education.

What Else Was in the Biden Student Loan Forgiveness Plan?

The most interesting points in the Biden Forgiveness Plan – outside of having $10,000 or $20,000 worth of debt canceled – were the proposals for improving access to the beleaguered Student Loan Forgiveness Program (SLFP). The big news has been the proposal to cut the amount of discretionary income that borrowers use to pay off loans from 10% down to 5%. Fortunately, this provision will move forward and should take effect by 2024, allowing borrowers to reduce the amount of their monthly payments.

One other note worth following: The DOE says it will continue making efforts to make community college free and to double the size of Pell Grants. The 2022 federal budget included a $400 increase to the Pell Grant maximum, bringing it to $6,895 for the 2022-23 academic year.

Sources:

- Stratford, M. (2023 July 5). Inside Joe Biden’s New Student Loan Repayment Plan. Retrieved from: https://www.politico.com/news/2023/07/05/inside-joe-bidens-new-student-loan-repayment-plan-00104723

- N.A. (2023 June 30). Fact Sheet: President Joe Biden Announces New Actions to Provide Debt Relief and Support for Student Loan Borrowers. Retrieved from: https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/30/fact-sheet-president-biden-announces-new-actions-to-provide-debt-relief-and-support-for-student-loan-borrowers/

- Turner, C. (2023 June 30) What the Supreme Court’s Rejection of Student Loan Relief Means for Borrowers. Retrieved from: https://www.npr.org/2023/06/30/1176839127/supreme-court-student-loan-forgiveness-decision

- Ferguson, H.T. (2022, October 11) White House Provides Detailed Preview of Student Loan Debt Cancellation Application. Retrieved from https://www.nasfaa.org/news-item/29145/White_House_Provides_Detailed_Preview_of_Student_Loan_Debt_Cancellation_Application

- N.A. (2022, August 24) Biden-Harris Administration Announces Final Student Loan Pause Extension Through December 31 and Targeted Debt Cancellation to Smooth Transition to Repayment. Retrieved from https://www.ed.gov/news/press-releases/biden-harris-administration-announces-final-student-loan-pause-extension-through-december-31-and-targeted-debt-cancellation-smooth-transition-repayment

- N.A. (2022, August 23) Thanks to Temporary Changes, U.S. Department of Education Announces Public Service Loan Forgiveness Surpasses $10 Billion in Debt Relief. Retrieved from https://www.ed.gov/news/press-releases/thanks-temporary-changes-us-department-education-announces-public-service-loan-forgiveness-surpasses-10-billion-debt-relief

- Kantrowitz, M. (2022, August 24) Is Student Loan Forgiveness By Executive Order Legal? Retrieved from https://thecollegeinvestor.com/35892/is-student-loan-forgiveness-by-executive-order-legal/