How to Increase Your Credit Score

There are a lot of tips and tricks on improving your credit score – and we’ll get to those in a moment – but nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously.

“If you are trying to give people advice for improving their score, pointing them toward those two components – things that are relatively easy to change – is a very good start,” said Tatiana Homonoff, an assistant professor of Economics and Public Policy at New York University, who did a two-year study on credit scores and published a paper on it.

Homonoff, who is affiliated with the Robert F. Wagner Graduate School of Public Service at NYU, added: “There are some parts of the credit score algorithm that are very hard to effect, but paying bills on time and being aware of credit utilization are things people can do with some ease, even if they’re in a tough financial position.”

Every consumer can take some crucial steps to improve their credit score.

- Pull your credit reports from all three major credit bureaus: You can contact the three credit bureaus, Experian, TransUnion and Equifax, and have them send you a free credit report once per year. This is a great way to review your credit activity and monitor fraud.

- Practice positive credit behavior: This means low credit utilization, avoiding predatory lenders, and managing a reasonable budget. Having multiple credit accounts open will help maintain a healthy credit score, but only if the accounts are up to date. Remember not to open too many accounts in a short period.

- Secured Credit Card: A secured credit card works similar to unsecured credit cards, but they are backed by cash you deposit. If you deposit $500 onto a secured credit card, this becomes your ‘credit limit’. Making on-times payments towards your accrued balance will help improve your credit score.

- Be patient and diligent: Credit scores won’t skyrocket overnight. These things take time. However, if you follow the proper steps, you will see a gradual improvement in your credit score.

How Credit Scores Are Calculated

FICO uses five major components in the equation that produces your credit score. Those five include:

- Payment history (35% of score): Do you pay on time? Do you pay the full balance, the minimum, or somewhere between?

- Amounts owed (30%): How much of the credit you’re allowed, do you use? You are seen as high risk and penalized if you exceed the credit limit. If you use less than 30% of the credit allowed, you’re considered a safe borrower and get a positive rating.

- Length of credit history (15%): The longer you have an account, the better the scorekeepers like it.

- Credit mix (10%): FICO likes to see a mix between credit cards, mortgages, and auto loans — as long as you can afford them! Don’t take out another loan in hopes it will improve your score. This category doesn’t count enough in the overall equation.

- New credit (10%): It’s OK to open new credit occasionally, but if you are applying for several accounts in a short period, you are a risk, and your score will reflect that.

Why Credit Is Important

Higher credit scores get you easier approval for loans with better terms. Borrowers with higher credit scores are low-risk and, therefore, will attract more lenders that offer favorable terms. Borrowers who want the best terms banks can offer should aim for a score above 760.

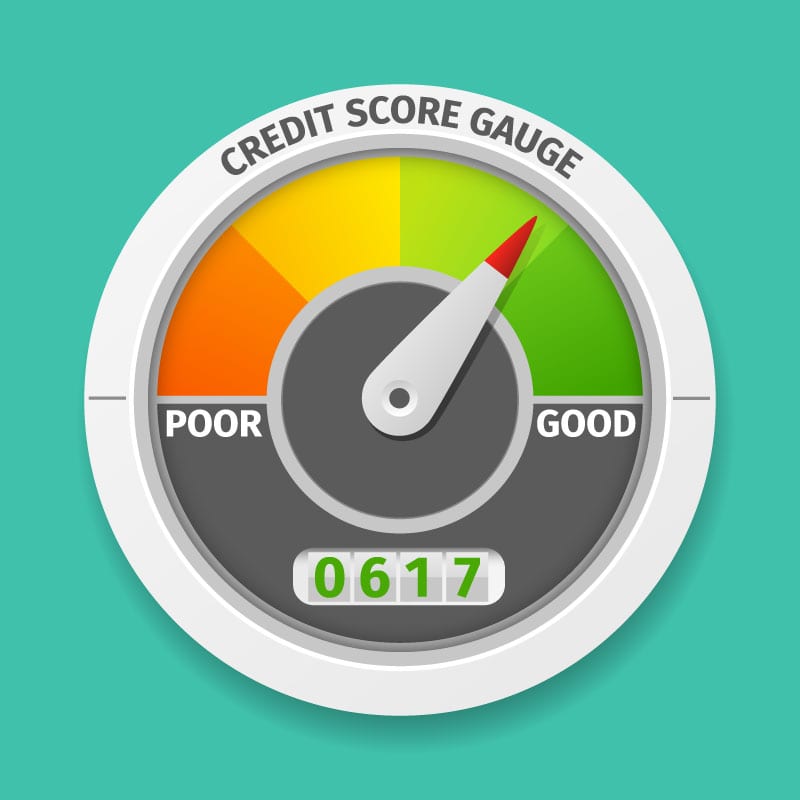

Credit scores range from 300 (poor) to 850 (excellent). Higher scores illustrate consistently good credit histories, including on-time payments, low credit use and long credit history. Lower scores indicate borrowers may be risky investments because of late payments or overextended use of credit.

As you go through life, your credit score will fluctuate. How much it fluctuates depends on how reliable you are at repaying debt on time, especially credit cards and installment loans. When you use credit more often, whether by taking on more credit cards, getting a mortgage, taking out a student loan, or auto loan, your credit score changes to reflect how you deal with the responsibility of more debt.

How to Check Your Credit Score

There are several free options available to check your credit score. The Discover Card is one of many credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar but not identical. The same goes for online sites like Credit Karma, Credit Sesame, and Quizzle.

Once you get your score, as Homonoff suggested, you might be surprised if it’s not as high as expected. These are ways to improve the score.

How to Improve Your Credit Score

Your credit score will change according to your spending habits and ability to manage credit accounts. If you make the right choices and know when to review your accounts, what to look for, and how to rectify mistakes on your credit report, you can ensure a healthy credit score. One must also make sure to practice healthy spending behaviors like responsible budgeting and monitoring your credit utilization ratio.

1. Review Your Credit Report

You are entitled to one free credit report a year from each of the three reporting agencies, and requesting one has no impact on your credit score. Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix. A Consumer Reports study found that 34% of consumers have at least one potential material error. Some are simple mistakes like a misspelled name, address, or account belonging to someone else with the same name. Other errors are costlier, such as accounts that are incorrectly reported late or delinquent; debts listed twice; closed accounts reported as still open; accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score once the false information is removed.

2. Set Up Payment Reminders

Write down payment deadlines for each bill in a planner or calendar and set up reminders online. Consistently paying your bills on time can raise your score within a few months.

3. Pay More Than Once in a Billing Cycle

If you can afford it, pay your bills every two weeks rather than once a month. This lowers your credit utilization and improves your score.

4. Contact Your Creditors

Do this immediately to set up a payment plan if you miss payment deadlines and can’t afford your monthly bills. Quickly addressing your problem can ease the negative effect of late payments and high outstanding balances.

5. Apply for New Credit Sparingly

Although it increases your total credit limit, it hurts your score if you apply for or open several new accounts in a short time.

6. Don’t Close Unused Credit Card Accounts

The age of your credit history matters, and a longer history is better. If you must close credit accounts, close newer ones.

7. Be Careful Paying Off Old Debts

If a debt is “charged off” by the creditor, they do not expect further payments. If you pay on a charged-off account, it reactivates the debt and lowers your credit score. This often happens when collection agencies are involved.

8. Pay Down “Maxed Out” Cards First

If you use multiple credit cards and the amount owed on one or more is close to the credit limit, pay that one off first to bring down your credit utilization rate.

9. Diversify Your Accounts

Your credit mix — mortgage, auto loans, student loans, and credit cards — counts for 10% of your credit score. Adding another element to the current mix helps your score as long as you make on-time payments.

10. Quick Loan Shopping

If you have bad credit and can’t find any other way to improve your score, you could consider taking a “quick loan.” These are typically loans for small amounts — $250 to $1,000 — that get repayment history reported to credit agencies and can become positive on your credit report. This is a last resort.

11. See If You Qualify for a 0% Interest Card

Several companies offer cards with 0% interest on balances, but there are caveats. There can be a fee for transferring the balance, and the 0%offer is only good for an introductory period, typically 12-18 months. It usually takes a very good credit score to qualify for one of these.

12. Consider a Debt Consolidation Plan

There could be a temporary drop in your credit score if you enroll in a debt consolidation program, but as long as you make on-time payments, your score quickly improves, and you are eliminating the debt that got you in trouble.

13. Pay Attention to Credit Utilization

Your credit utilization rate is the amount of revolving credit you use divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit means credit cards, but it includes personal and home equity lines of credit. A good credit utilization rate is at most 30%. So, if you have a credit limit of $5,000, you should use at most $1,500.

How Long Does It Take to Rebuild Credit?

Typically, it takes at least 3-6 months of good credit behavior to see a noticeable change in your credit score. While it is impossible to put a specific time frame on credit repair, it is safe to say the less negative information you have on your report – late payments, maxed-out credit cards, constant credit applications, bankruptcy, etc. – the easier it is to repair your credit score.

Though some lenders offer loans with bad credit, they cost hundreds or thousands of dollars in higher interest rates when borrowing. A poor credit score can also be a roadblock to renting an apartment, setting up utilities, and getting a job!

Here are some time frames for negative information that detracts from your credit score.

- A delinquent account remains on your credit report for seven years.

- Car repossession stays on your report for seven years.

- Chapter 7 bankruptcy is on your report for ten years. Chapter 13 remains for seven years.

- Credit application inquiries stay on your report for two years.

- Public record items such as property liens are on your report for seven years.

Remember that the damage to your credit score diminishes over time. So, for example, a Chapter 13 bankruptcy in Year Six has a negligible impact compared to its effect in Year One.

Establishing a Credit Score

If you don’t have any credit history, get started! A favorable credit history helps out nearly every aspect of your financial future, whether it’s purchasing a car, renting or buying a home, or even applying for a job.

The easiest way to start is to apply for a line of credit. Credit cards for gas stations or department stores are generally easy to obtain and using a credit card to build your credit is a solid strategy. Another option is a small personal loan to build credit. But use them responsibly, being careful not to overspend. The key is to pay your bill on time each month.

Establish yourself as an authorized credit card user on your spouse, relative, or close friend’s credit account. Becoming an authorized user takes a phone call to the card issuer by the cardholder, permitting one to use the card without paying the bill.

Paying off the balance becomes the responsibility of the cardholder. In the meantime, you acquire the purchasing power of a credit card and have the cardholder’s credit history added to yours. That provides an opportunity to add three positives right away to your credit report:

- An increase in the number of years using credit

- An increase in the average age of credit cards you use

- An increase in the credit utilization available on your cards

Combining those three elements alone could raise your credit score from 50–100 points.

On the other hand, if the cardholder is late with payments, maxes out the card every month, or does anything else negative, it will hurt the credit scores of both the cardholder and the authorized card user.

And any negative activity you create can impact the cardholder’s credit score. If you max out the card and the cardholder is late with payments or can’t make them, it is a negative on their account — and, at some point, on yours too.

Working with a Credit Counselor

Credit counseling is an excellent opportunity for borrowers who need assistance managing their finances, establishing a monthly budget, and paying off debts.

These programs are often run by nonprofit credit counseling agencies. The U.S government sets strict rules in place for nonprofit credit counseling agencies, requiring them to make public their financial and operating information. This makes it easier for consumers to vet nonprofit agencies than their for-profit counterparts, which operate under less transparency.

Nonprofit credit counseling is an affordable option for borrowers who need clear advice and concrete steps for taking immediate action to solve their financial problems. Credit counselors are available to answer questions and build a budget that accounts for a borrower’s income, expenses, and long-term financial goals.

Sources:

- Homonoff, T., OBrien, R., Sussman, A, (2018, February 23) Does Knowing Your FICO Score Change Financial Behavior? Evidence from a Field Experiment with Student Loan Borrowers Retrieved from https://ssrn.com/abstract=3129075

- NA. (2017, June 8) What are common credit report errors that I should look for on my credit report? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-are-common-credit-report-errors-that-i-should-look-for-on-my-credit-report-en-313/

- Klein, A. (2017, September 28) The real problem with credit reports is the astounding number of errors. Retrieved from https://www.brookings.edu/research/the-real-problem-with-credit-reports-is-the-astounding-number-of-errors/

- NA. ND. How to Improve Your Credit Score. Retrieved from https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

- NA. (2016, September 23) 5 Factors that Determine a FICO Score. Retrieved from https://blog.myfico.com/5-factors-determine-fico-score/