Department of Education Nets $41.3B Profit in 2013 from Student Loans

A new government report shows the U.S. Department of Education generated $41.3 billion from federal student loans in the 2013 fiscal year, making it the third most profitable industry in the global economy behind Exxon and Apple.

The Congressional Budget Office (CBO) released the report in November. Its figures, which track the fiscal year that ended Sept. 30, show the department’s profit level trailed closely behind the 2012 profits of Exxon Mobile, estimated at $44 billion; and the iPhone and iPad maker, which cleared about $41.7 billion.

In true government fashion, the same CBO report shows the department’s numbers may be inflated dramatically because of the choice of accounting methods for student loans — an industry that is growing dramatically every year, and is dominated by the Department of Education. The CBO uses an accounting method mandated by the Federal Credit Reform Act of 1990.

The DOE funded approximately 12 million student loans for the 2012 school year, and the average student borrowed about $6,500. Students must start paying back their loans within six months of graduating, dipping below half-time status or dropping out of school.

Student loan debt passed the $1 trillion mark in 2012, moving ahead of the credit card industry in terms of money owed. Now, only homeowners have more debt than students, with the difference being that home loans can be dismissed in bankruptcy, while student loans can’t.

Effects of Student Loan on Economy

About 66 percent of college graduates leave school owing money. The average amount is now about $35,000 and that figure rises every year. Student debt in 2013 is four times what it was in 2003 and the number of people impacted has soared along with it.

The effect on the U.S. economy is noticeable already and could become staggering as more and more young buyers have their hands tied, paying back student loans. Money that could go toward purchases that fuel a thriving economy — homes, cars, major appliances — instead is being sent to the government to pay off student loans.

There are long-term ramifications as well. Students begin retirement savings much later in life and miss out on the compounding effect that is vital to accumulating a comfortable retirement account. By the time they reach retirement age, the person who started saving at 25 will have twice as much in their account as the person who began putting money away at 35.

Is Accounting Method to Blame for Profit Amount?

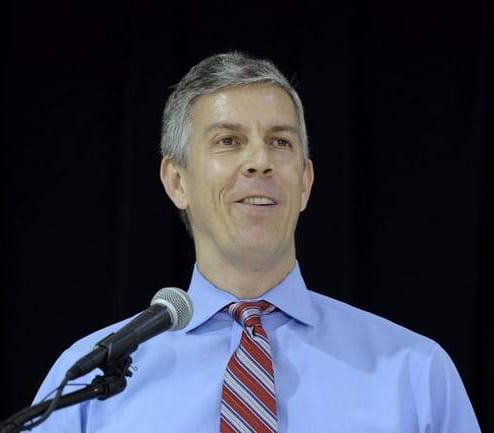

The fact the government is making money — and raised rates on loans over the summer — has drawn the ire of many students and families, but Education Secretary Arne Duncan says the wrath is misguided.

“It’s actually neither accurate nor fair to characterize the student loan program as making a profit,” Duncan said during a conference call with reporters last summer.

Duncan is basing his statement on a method called “fair value accounting” used occasionally by the CBO, just not on student loans. That method acknowledges the market risk that accompanies lending money, and estimates its “discount rate” (the expected rate of return) based on loans with similar risks and returns.

If the CBO used the fair value accounting method for student loans, the government’s profit goes down to just above the $5 billion mark. Throw in administrative costs and proponents of that accounting method say the result would be no real profit, maybe even a loss on student loans.

Sources:

- Jesse, D. (2013, November 25) Federal government books $41.3 billion in profits on student loans. Detroit Free Press. Retrieved from (http://www.freep.com/article/20131125/NEWS05/311250021/Federal-government-profits-on-student-loans

- Matthews, D. (2013, May 20) No, the federal government does not profit off student loans (in some years – see update). Washington Post. Retrieved from http://www.washingtonpost.com/blogs/wonkblog/wp/2013/05/20/no-the-federal-government-does-not-profit-off-student-loans/

- NA, (2013, November 26) US government “profits” from student loans in 2013 surpassed $41 billion. RT.com. Retrieved from http://rt.com/usa/student-loans-government-profit-292/