Category:

Credit

Types of Consumer Credit & Loans Consumer loans and credit are a form of financing that make it possible to purchase high-priced items you can’t pay cash for today. Banks, credit…

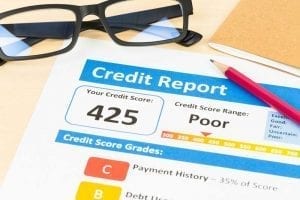

The recent data breach at Equifax, one of the three major credit reporting bureaus, has created an uncomfortable situation for the more than 145 million American consumers whose personal information…

Once in a while, situations arise in which you might need a substantial chunk of extra money, but don’t have substantial collateral – house, car, property of some kind –…

What is a Debt Management Plan? How can it help? A debt management plan is NOT a loan. In a typical program, debt management companies work with creditors on your…

What is a Secured Loan? A secured loan refers to a loan contract in which the borrower puts up collateral (like their home or car) to acquire immediate cash. They…

Unsecured debt is any debt that is not tied to an asset, like a home or automobile. This most commonly means credit card debt, but can also refer to items…

What Are Personal Loans? Personal loans used to be a simple part of the American economy. Homegrown savings and loans lent money to buy boats and barbeque pits based on…

It doesn’t take long after you buy a car for it to be worth less than what you owe. Owing more than the vehicle is worth is known as “being…

The Consumer Financial Protection Bureau, which prides itself on being the watchdog for U.S. consumers, has been snarling at America’s three major credit bureaus for a while and finally decided…

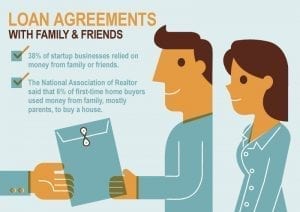

Friends, family, and financial institutions may have more in common than you think. Millions of people turn to their personal networks for financial assistance each year, whether to meet unexpected…