Bankruptcy Statistics

Home > Bankruptcy >

Bankruptcy is a scary notion to many, but for those caught in challenging financial situations that involve heavy debt, bankruptcy is a viable option to gain a new start.

Most cases of bankruptcy aren’t caused by reckless spending but by financial hardship, and many are lower-income individuals who simply can’t afford to deal with unexpected major expenses such as job loss or medical bills.

Peaks in bankruptcy petitions typically signify economic downturn, and states with fewer consumer-friendly laws typically see the most filings. Consumers could consider debt consolidation options – debt management plans, debt consolidation loans and debt settlement – as an option to avoid filing for bankruptcy.

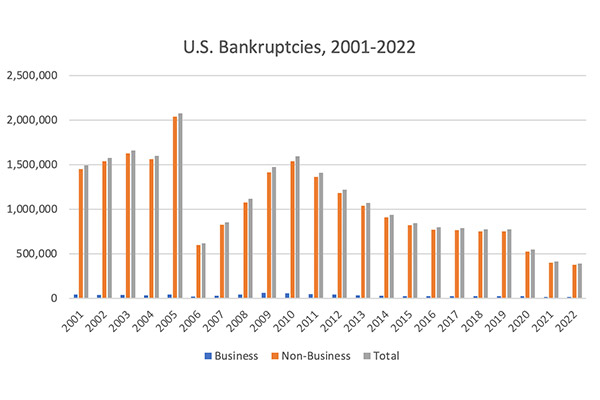

Number of Bankruptcy Filings

Bankruptcy filings dropped during the pandemic as federal aid helped people pay their bills.

The most recent bankruptcy statistics from the United States Courts showed that for 2022, bankruptcy filings dropped 6.3% from the previous year. That means a drop from 413,616 filings to 387,721.

However, as the aid has ended, bankruptcies increased. In January of 2023, bankruptcy filings increased by 19% compared to January of the previous year. In February 2023, total filings increased 18% compared to February ’22 (all stats according to Epiq Bankruptcy, the leading provider of U.S. bankruptcy data).

While this number is significant and total filing numbers increased by 2% in February compared to January, two months may not make for a trend. The overall numbers are still lower than pre-pandemic numbers, but do reflect the pain caused by inflation.

“The growing number of households and businesses filing for bankruptcy reflects the mounting economic challenges they now face,” said Amy Quackenboss, Executive Director of the American Bankruptcy Institute. “Debt loads are expanding as the prices of goods and services have gone up with inflation and the cost of borrowing continues to rise. While pandemic relief efforts have largely expired, the safe haven of bankruptcy is continually available for financially distressed businesses and consumers.”

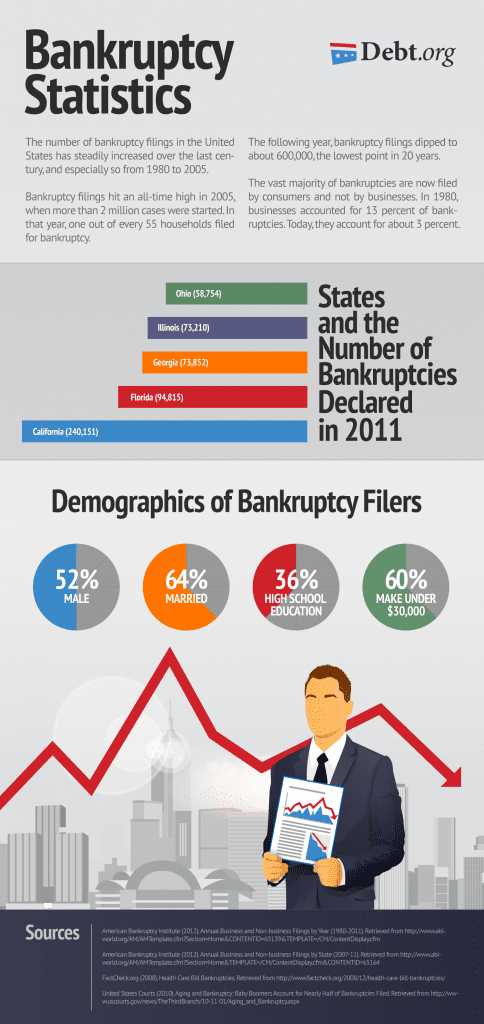

Bankruptcy filings hit an all-time high in 2005, when more than two million cases were filed. In that year, one out of every 55 households filed for bankruptcy. The following year, bankruptcy filings dipped to about 600,000, the lowest point in 20 years.

The last three years have shown the impact of the pandemic and how relief aid helped. In 2019, the year before COVID, there were 777,940 filings. That’s just less than the sum of all filings for 2021 and 2022 combined. In 2020, filings dropped 30%.

Source: U.S. Courts

Business and Non-Business Bankruptcy Filings

Bankruptcy filings can be personal or business-related. Personal filings happen when an individual cannot pay his or her bills and is swamped with debt. Business filings happen when a business is in a financial bind, be it a large retail outlet or a mom-and-pop shop.

The vast majority of bankruptcies are filed by consumers and not by businesses. In 1980, businesses accounted for 13% of bankruptcies. In 2022, they accounted for 2.9%.

| Business | Non-business | Total | |

|---|---|---|---|

| 2022 | 13,481 | 374,240 | 387,721 |

| 2021 | 14,347 | 399,269 | 413,616 |

| 2020 | 21,655 | 522,808 | 544,463 |

| 2019 | 22,780 | 752,160 | 774,940 |

| 2018 | 22,232 | 751,186 | 773,418 |

Source: U.S. Courts

Bankruptcy Filings by Chapter

Filing bankruptcy meaning choosing which “chapter” applies to your situation.

Chapter 11 is a business bankruptcy, Chapter 7 and Chapter 13 are personal. In Chapter 7, non-essential assets are sold (not including your house) and the money raised is used to discharge debts. In Chapter 13, a 3–5-year payment plan to pay down debt is agreed to with the court.

The goal of any bankruptcy is to have debts discharged, which gives you a new start to right your financial ship.

Here is a look at the number of bankruptcies by most common Chapters the past five years:

| YEAR | Chapter 7 | Chapter 11 | Chapter 13 |

|---|---|---|---|

| 2022 | 225,455 | 4,918 | 157,087 |

| 2021 | 288,327 | 4,836 | 120,002 |

| 2020 | 378,953 | 8,333 | 156,377 |

| 2019 | 480,206 | 7,020 | 286,979 |

| 2018 | 475,575 | 7,095 | 290,146 |

Source: U.S. Courts

States with High Numbers of Bankruptcies

The number of annual bankruptcies varies widely by state and is a function of state population and policies.

According to Statista, the state with the most bankruptcies in 2022 was California, with 31,702. It’s good to maintain perspective though. In 2011, California had more than 240,000 filings, so the number has dropped significantly.

At the other end of the spectrum, Alaska had the fewest filings with 182, Vermont second lowest with 207.

The five states with the most bankruptcy petitions in 2022 accounted for 31% of the year’s filings nationwide:

These states and the number of bankruptcies declared in 2022 are as follows:

- California: 31,792

- Florida: 26,724

- Georgia: 22,815

- Illinois: 20,393

- Texas: 19,553

Causes for Bankruptcy

Medical bills are a significant factor in bankruptcy filings. The Kaiser Family Foundation showed that 41% of U.S. citizens carry some sort of medical debt, and 24% were considering bankruptcy to solve a medical debt issue.

However, while some bankruptcies were related to outstanding medical situations, other factors cause people to file. Among them: Loss of job, an unaffordable mortgage, overspending (including on credit cards), divorce, and helping other family members with financial assistance, which while noble can put the lender/gifter in a bad position if his or her financial house is not in order.

Changing Demographics of Bankruptcy Filers

It is not easy to place bankruptcy filers into specific groups. The main causes of bankruptcy remain constant over the years: Job loss and medical expenses. Job loss means loss of income, which brings a fear about caring for yourself and your family. Medical expenses in our system remain one of the top drivers of debt, which can lead to bankruptcy.

Age at Bankruptcy

Since the early 1990s, bankruptcy has been used with increasing frequency by older individuals. From 1991 through 2018, the rates of people 65 and older who filed increased by three times.

While seniors make up only 8% of total bankruptcy filings, the number of those filing aged 55 and older has doubled in the past 16 years. Those 55 and older account for 20% of all bankruptcy filings.

Repeat Filers

Recent studies have found that 8% of those who file for bankruptcy have filed at least once before. These repeat filers are responsible for 16% of all bankruptcy cases.

Some experts believe that bankruptcy laws are exploited, pointing to repeat filings as proof. Though the government has enacted policies to curb abuse of the bankruptcy system, these new policies have had little to no effect on who declares bankruptcy and when.

Gender and Marital Status

About equal numbers of men and women file bankruptcy, with a ratio of 48 men-to-52 women. Over the last few years, the gap has been shrinking.

Married individuals are making up an increasing portion of bankruptcies – more than 64% in 2010. That number includes married couples filing jointly.

In addition, 17% of debtors are single, 15% are divorced and 3% are widowed.

Education Level

About 20% of 2010 bankruptcy filers held a bachelor’s degree or higher, up from 16% four years earlier.

About 36% of filers have a high school education level, while another 29% have some college education.

The cause would seem to point to the financial burden of student loans. Discharging student loan debt is terribly difficult n bankruptcy – the reason that only 0.1% of all bankruptcy filings caused by student loans were discharged each year.

In 2022, President Joe Biden’s administration announced new policies that would make it easier for student loan debts to be discharged. Prior to that announcement, filers had to show student loans caused an “undue hardship,” which essentially meant suing the lender. This was extremely difficult and meant many chose not to even pursue that course. With that policy, student loans were treated differently in bankruptcy than credit card, medical or other consumer debt.

Biden’s policy changes were meant to simplify the process of showing hardship and make it easier for government lawyers to recommend that student loan debt be discharged. Most consumer groups praised the policy change, but it ended up in court, which will determine if the Biden plan is legal

Income Level

A 2011 study found that 60% of bankruptcy filers have salaries of less than $30,000 and may have had options for low-cost bankruptcy. This reflected a decrease from about 66% four years earlier.

Over the same period, an increasing percentage of filers reported making more than $60,000 annually. This demographic grew from comprising 5.5% to 9.2%.

No one is immune to severe financial troubles. If you find yourself struggling financially, consider debt settlement and debt consolidation before turning to bankruptcy.

Talk to a Credit Counselor before Filing for Bankruptcy

All individuals who are considering filing bankruptcy must speak with a credit counselor. This counseling session is a required step, and it may help individuals avoid filing because it finds another solution that better fits the individual’s or business’ financial situation.

A credit counselor from a nonprofit agency is required by law to provide the best financial advice for each situation. Credit counseling typically is free and can be done with a phone call. The counselor will assess your situation and provide the best advice for eliminating debt.

One of the options that may work if credit card debt is an issue is debt management. With this plan, credit card interest rates are reduced to a more manageable figure, and one single payment is made to the agency handling the debt management plan. That option would be assessed during credit counseling.

Sources:

- U.S. Courts (2023, February 6) Bankruptcy Filings Drop 6.3%. Retrieved from https://www.uscourts.gov/news/2023/02/06/bankruptcy-filings-drop-63-%

- N.A. (2023, February 3) January Year-over-Year Bankruptcy New Filings Increase Across All Main Chapters. Retrieved from https://www.epiqglobal.com/en-us/resource-center/news/january-year-over-year-bankruptcy-new-filings-incr

- Kuadli, J. (2022, December 7) 9 Mind-Blowing Bankruptcy Statistics for 2022. Retrieved from https://legaljobs.io/blog/bankruptcy-statistics/

- N.A. (ND) Number of bankruptcy filings in the United States in 2022, by state. Retrieved from https://www.statista.com/statistics/303566/bankruptcy-filings-us/

- Cussen, M. (2023, February 19) Top 5 Reasons Why People Go Bankrupt. Retrieved from https://www.investopedia.com/financial-edge/0310/top-5-reasons-people-go-bankrupt.aspx

- Minsky, A. (2022, November 17) Biden Administration Announces Huge Bankruptcy Changes For Student Loans. Retrieved from https://www.forbes.com/sites/adamminsky/2022/11/17/biden-administration-announces-huge-bankruptcy-changes-for-student-loans/?sh=7f3bfd7a2c6f

- Lobosco, Katie (2022, November 17) Biden administration makes it easier to discharge student loan debt in bankruptcy. Retrieved from https://www.cnn.com/2022/11/17/politics/student-loan-debt-bankruptcy/index.html