Category:

Real Estate

A lot of people would rather inherit a doghouse than a timeshare. At least the doghouse won’t require a $1,000 annual maintenance fee. If someone dies and leaves you a…

As the Federal Reserve plays Whac-A-Mole with the American economy – ‘WE’RE IN A RECESSION! NO, WAIT, WE’RE NOT IN A RECESSION!’ – there is always the chance the mallet…

Losing your home to foreclosure is a scary and depressing prospect. Aside from the short-term need for housing, there is the longer-term damage it does to your financial future. But…

Mom or Dad were good at saying vague things like “Don’t bite off more than you can chew,” or “Your eyes are bigger than your stomach.” Or specific things like,…

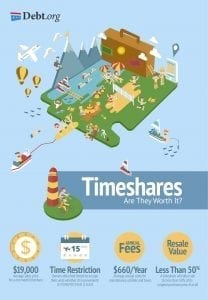

Congratulations, you’ve bought a timeshare! If you are like a lot of people, your next move will be trying to get rid of it. Buyer’s remorse grips a lot of…

Be wary the next time you check into a resort and are offered a free gourmet dinner or a massage or Disney World tickets if you’ll just attend a 90-minute…

Buying a house is usually the largest purchase any of us will make. It rarely can be accomplished quickly and easily. And yet, as a country, we are always on…

Even in the best of times, making monthly mortgage payments is rarely as comfortable as a pair of old slippers. The real estate “boom” is misleading. Houses might be selling…

Data shows that homeownership among millennials is down, but that doesn’t mean they aren’t interested in buying a home. In the last two decades, homeownership in the U.S. has declined…

JPMorgan Chase Bank agreed to pay a $13 billion fine to the U.S. government for its role in the disastrous mortgage lending practices that landed more than 15 million American…