Staff Writer

Bill Fay

Bill “No Pay” Fay has lived a meager financial existence his entire life. He started writing/bragging about it in 2012, helping birth Debt.org into existence as the site’s original “Frugal Man.” Prior to that, he spent more than 30 years covering the high finance world of college and professional sports for major publications, including the Associated Press, New York Times and Sports Illustrated. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Borrowers who’ve gotten themselves tangled in a charge-off situation face difficult choices. Pay the debt in full? Try to settle for a lesser amount? Run away and hide? “The world…

For those seeking a fresh financial start, Chapter 7 bankruptcy has plenty of upsides. It’s the cleanest, most straightforward, least time-consuming, and least expensive of the various bankruptcy options. The…

When people get married, they often vow to take each other through thick and thin. Bankruptcy can get pretty thick for a husband and wife. Bankruptcy is when a person…

Growing older never was for the fainthearted, but it takes exceptional courage to navigate those Golden Years with dents on your credit report and a need for cash. Chins up,…

Choosing to declare personal bankruptcy can be among the most difficult decisions ever to confront an individual. Tougher still: Having to pick, under unmatched duress, which type of bankruptcy best…

There are plenty of reasons to consider making car loan payments with a credit card — everything from piling up rewards points or cash back, to scoring a bit of…

With President Biden declaring an end to pandemic emergency provisions effective May 11, and states and companies already having rescinded most of their debt collections suspensions, debt collectors are totally…

A bankruptcy discharge is the legal holy grail for anyone who files for bankruptcy. A discharge means there’s a court order in the bankrupt’s case that erases all qualifying debts.…

Debt Relief Programs in South Carolina Those who are struggling to pay off debt in South Carolina can find programs to help through banks, credit unions, online lenders, and for-profit…

Debt Relief Programs in Missouri Missouri residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for-profit and nonprofit debt relief companies. These…

If you have so much debt that you’re considering filing a Chapter 7 bankruptcy, you have enough debt to qualify. The U.S. bankruptcy code doesn’t specify a minimum dollar amount…

Debt Relief Programs in Minnesota There are banks, credit unions, online lenders, and debt-relief companies (for-profit and nonprofit) in Minnesota that specializes in helping consumers pay off credit card debt. These companies…

A rare silver lining to the Covid pandemic was Americans managed to pay down billions of dollars in credit card debt. Those days have screeched to a halt. Credit card…

Debt Relief Programs in Indiana There are banks, credit unions, online lenders and debt-relief companies (for profit and nonprofit) in Indiana that specialize in helping consumers pay off credit card debt.…

Debt Relief Programs in Wisconsin Wisconsin residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for profit and nonprofit debt relief companies.…

Debt Relief Programs in Washington There are a number of resources available for residents of the Evergreen State who find themselves in financial peril. Banks, credit unions, online lenders, for…

Debt Relief Programs in Tennessee Tennessee has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

Debt Relief Programs in Colorado Colorado has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

Bankruptcy is a legal proceeding that could provide relief when a person can’t repay debts. Consider bankruptcy a legal life preserver for those drowning in debt. Chapter 7 bankruptcy is…

Debt Relief Programs in Maryland Debt relief in Maryland can come from several entities, among them, banks, credit unions, credit counseling agencies (nonprofit and for-profit), and online lenders. The goal:…

Everyone knows the old saying: Time flies when you’re procrastinating. Seems like only yesterday we were breezing past April 15 — the traditional deadline for income tax filing — and…

Don’t plan on receiving and cashing a second COVID-19 stimulus check just yet. A group of 20 fiscal hawks, many of the close advisors to President Trump, sent Trump and…

While Governors in several states are trying to crack open the door on the shuttered U.S. economy, the news from two key elements of a would-be revival – employment and…

Truth, they say, is the first casualty of war. And on March 13, President Donald Trump put America on a war footing. We’re coming for you, coronavirus. Speaking from the…

Surveys show most Americans will make a resolution to get out of debt in 2020. Surveys also show most Americans will fail miserably. If you want to get out of…

The announcement that FICO will put two new credit scoring models – FICO 10 and FICO 10T – into play this summer is the ultimate good news/bad news situation for…

Tempted to spend lavishly and spontaneously this holiday season? Looking for someone to blame? Leave the three wise men out of it. Yes, they launched the tradition of bestowing expensive…

A drowning person wants somebody to throw them a life preserver. People drowning in student debt might have just been thrown a bowling ball. The government’s new student loan watchdog is…

Americans are taking on ever larger debt loads as they struggle to maintain living standards. They are borrowing more on their credit cards, taking on a soaring levels of student…

With Donald Trump being credited or blamed for virtually every imaginable good or ill (depending on the observer, of course), we in the world of personal finance and debt management…

The U.S. economy might be bustling for civilians, but not all active enlisted members of the military are thriving in it. More than one-third of enlisted military members do not…

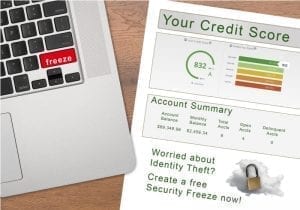

Security breaches have become so commonplace in the United States that news around them barely causes a ripple these days. Even if it’s news that provides consumers an extra layer…

Across America, home values are on the rise again, surging with the economy. With that surge, homeowners eager to scratch a pent-up-demand itch once again are taking out HELOCs, or home…

The loan business is getting personal. We’re talking personal loans, and they are exactly what they sound like. You borrow money from a lending institution and pay it back. The…

The era when almost anyone with a pulse could get a loan or mortgage from a commercial bank ended with the financial meltdown of 2008. Today, tightened regulations and a…

Here’s a warning for anyone who must borrow money for college. There’s an assault under way on the most cost-effective and popular student-loan repayment programs. Lines are being drawn and…

Interest rates are going up, so it’s time to seriously consider refinancing your home loan. Or if you want to buy a house, it would be wise to seriously consider doing…

American consumers owe a record $1.023-trillion in revolving credit – mostly through credit-card debt – and with interest rates expected to rise in 2018, financial experts predict the problem will…

If you’re one of the millions of Americans for whom payday can’t come soon enough, technology is catching up with your dreams. Uber, McDonald’s and Outback Steakhouse are among a…

Military veterans are more likely to suffer through credit problems, underwater mortgages and late house payments than the civilian population. Those are some of the findings from a 2017 analysis…