Staff Writer

Bill Fay

Bill “No Pay” Fay has lived a meager financial existence his entire life. He started writing/bragging about it in 2012, helping birth Debt.org into existence as the site’s original “Frugal Man.” Prior to that, he spent more than 30 years covering the high finance world of college and professional sports for major publications, including the Associated Press, New York Times and Sports Illustrated. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Using social media websites is now one of the most effective ways to connect with others. These sites are used not only for personal connections, but also are increasingly used…

A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. The consequences of default depend on whether your loan is…

If you own a home, these things are true: At one time, you probably bought the property, so you are familiar with what it takes to find real estate, apply…

The picture that many people have in mind when they think about the stereotypical debt collector is a hard-hearted scoundrel of melodrama infamy, threatening to throw widows and orphans into…

Having to confront the consequences of outstanding debts can be an upsetting and worrisome experience. Regardless of how one fell into debt – whether from overspending, a medical or family…

You want to save for retirement, but you’re still getting billed each month for old debts. Can you really justify starting a retirement fund when you have credit card bills,…

More than four million borrowers have defaulted on student loans, but if they’re hoping bankruptcy will bail them out, they better have a Plan B. The majority of consumer debt…

Some borrowers who are looking for trustworthy lenders are simply swayed by news out of the financial sector, news that documented at a rash of bank failures and subsequent efforts…

A short sale of a house happens when a lender agrees to release a homeowner from his or her mortgage for less than what is owed so the property can…

Foreclosure Defense Facing foreclosure? Call for nonprofit help. Depending on your situation, you may be able to access grants, government assistance programs and/or a mortgage modification that can help you…

Benefits for America’s military veterans go back to 1636 when the Pilgrims passed a law to support disabled soldiers. Problems claiming those benefits have existed since then. There are just…

Article 1, Section 8, of the U.S. Constitution empowers Congress to borrow money against the full faith and credit of the government. And since its beginning as a sovereign nation,…

Consumers’ financial identities are always at risk. A single late payment might bring down your credit score, a clerical error may lead to inaccurate or outdated information being reported, and…

Every consumer should be interested in their credit score, especially if they are considering a major financial move that will require a loan. Anyone wanting credit for a mortgage, auto…

Banking used to be simple. Bankers lived by the 3-6-3 rule — borrow at 3 percent, loan at 6 percent, and hit the golf course by 3 in the afternoon.…

Where can you go in today’s economy with good credit? Just about anywhere! Where can you go in today’s economy with bad credit? Just about nowhere! Building good credit has…

You can be insolvent without being bankrupt, but you can’t be bankrupt without being insolvent. Confused yet? Many people think of the two as the same thing, but they are…

Bankruptcy laws go all the way back to the U.S. Constitution and have seen many changes over the years. Article 1, Section 8, Clause 4, of the Constitution authorizes Congress…

The demand for doctors and nurses in the United States is extremely high, but so is the cost of education for both professions. More than 76% of the 2016 medical…

Prospects for U.S. veterans returning to the civilian workforce have improved dramatically since the Great Recession of 2008, when unemployment spiked and newly discharged service members struggled to find any…

Medical debt and the problems they cause credit reports, have long gone hand-in-hand. Consumers behind on payments to healthcare providers, especially those whose bills have been sold to collection agencies,…

With a nod to Mark Twain, inflation has replaced the weather as the thing everyone talks about it, but nobody seems to do anything about it. Until now. Not that…

America has turned into a nation of quitters, though that’s not necessarily a bad thing. Spurred by the COVID pandemic, millions of people have joined “The Great Resignation” that’s happening…

The rules governing repayment of federal student loans contain so many nooks and crannies that it shouldn’t come as a surprise that you may have missed one created during the…

The average Joe – not Biden – figures to benefit most from passage of the $1.9 trillion American Rescue Plan. Approximately 145 million Americans will receive a third round of…

Biden wants the minimum wage – currently set at $7.25 an hour – to jump to $15 an hour by 2025. The increases would be phased in at approximately $1.75…

President-elect Joe Biden unveiled the American Rescue Plan, a $1.9 trillion war on the prolonged suffering of Americans hardest hit by coronavirus. Included in his proposal: a fresh round of…

The second COVID-19 relief bill is now law – all 3,126 pages of it. The people in Congress who passed it admit they don’t know what all is in it,…

If you haven’t looked at your bank account this week, now might be a splendid time. The long wait for a second stimulus check from the U.S. government finally is…

A second stimulus check – the financial gift from the U.S. government to help consumers recover from the economic belt coronavirus gave the American economy – needs only a signature…

If the biggest employee benefit you receive is when your company bothers to fill the toilet paper rolls in the employee bathroom, you might not want to read this: Google…

If you are paying on a federal student loan, you probably already know that the government CARES Act has provided benefits that suspends payment and interest requirements through May 1,…

Americans with student loan debt have a $1.6 trillion question on their minds: What would President Trump or a President Biden do about all that money these 45 million borrowers…

The COVID-19 pandemic has created record unemployment, erased profit margins, closed businesses and wreaked havoc on almost every family’s money outlook. It has even affected America’s ultimate get-out-of-jail financial symbol…

Veterans indebted to the Department of Veterans Affairs won a partial payment reprieve this summer that will last at least through the end of 2020. The VA action extends a…

Dorothy surely wasn’t thinking of life in a COVID-19 pandemic when she clicked those heels in the “Wizard of Oz” and opined that ‘there’s no place like home.’ But her…

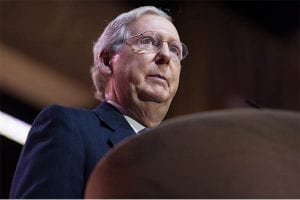

Congress and the White House are still debating whether the HEALS Act, HEROES Act – or some compromise Act in between – will deliver the next round of coronavirus relief…

When the House of Representative passed the $3-trillion HEROES Act on May 15, it all but guaranteed that a second stimulus check would arrive for Americans in need of financial help…

The storm is coming. American consumers will be filing personal bankruptcies in record numbers by the end of 2020. That is the projection from bankruptcy attorneys, bankers and other experts…

The phrase “stimulus check” is second only to “coronavirus” or “COVID-19” as something to talk about these days and people are definitely talking. About 159 million Americans have received the…