Demographics of Debt

The famed patriot Patrick Henry proclaimed “Give me liberty … or give me death!” at America’s founding.

As the country emerges from the COVID-19 pandemic, Americans’ motto has changed to “Forget financial liberty … give me debt!”

American household debt hit a record $16.9 trillion at the end of 2022, up $2.75 trillion since 2019, according to the Federal Reserve. If you had to write that check it would read $16,960,000,000,000.

Americans owe $986 billion on credit cards, surpassing the pre-pandemic high of $927 billion. We owe $11.92 trillion on mortgages, $1.55 trillion on vehicle loans and $1.60 trillion for student loans.

With average consumer debt in America on the rise, it’s no surprise that debt delinquency – missed payments of 30 days or more – has increased for nearly all debt types.

Even with that $16.9 trillion shared by about 340 million people, consumer debt statistics show that Americans are feeling the pain.

Who is most likely to get into debt? More importantly, who is most likely to get out of debt? Age, income, ethnicity, family type and education all play apart. Demographics, however, don’t strictly determine debt risk.

Understanding debt statistics and what’s behind them will help you manage your finances, get out of debt and find financial liberty. To get you started, here’s a look at debt statistics in America.

Inflation and Supply Chain Issues

Supply chain issues began during the earliest days of the COVID-19 pandemic. A shortage of workers, restricted work hours, and companies closing (either temporarily or for good), meant less “supply.”

In other words, fewer goods available. Lack of supply created a domino effect that continues to cause issues with the economy.

A major issue resulting in a large part from supply chain issues was inflation. When prices for goods rise rapidly, it costs more to get through the day, feed your family, pay for heat and electricity, and more.

Obviously, inflation and supply chain shortages have a big impact on household debt. The impact comes from both ends – cars, houses, and other big-ticket items are more expensive, making loans to buy them cost more. The other impact is that the more everyday things like food and clothes cost, the more people have to turn to credit cards.

Inflation peaked at 8% in the summer of 2022, a 40-year high. While it is slowly easing, the ripple effect on the average consumer’s budget continues.

When the amount American consumers owe for auto loans and mortgages began to level off, the amount they owed on credit cards spiked. Delinquency rates dipped during the COVID-19 pandemic, but by the end of 2022, about 2.5% of American debt was in delinquency, climbing toward the 4.7% it had been just before the pandemic hit.

Average American Debt by Age

While anyone can get into debt and have trouble paying their bills, the latest American debt statistics show that younger people are falling behind faster and going into delinquency, particularly on credit cards and auto loans.

Younger borrowers have surpassed pre-pandemic rates on delinquency. Delinquency rates for older borrowers are rising, but haven’t reached pre-pandemic levels.

Here’s a look at how much nonmortgage debt Americans have by age group, and the average non-mortgage per capita debt for each group:

- 18-29-year-olds: $69 billion total, $12,871 average

- 30-39-year-olds: $1.17 trillion, $26,532 average

- 40-49-year-olds: $1.13 trillion $27,838 average

- 50-59-year-olds: $98 billion, $23,719 average

- 60-69-year-olds: $64 billion, $16,661 average

- 70 and older: $36 billion $9,827 average

Average Debt to Income Ratios

Debt to income ratio is a key indicator of financial health. It’s determined by taking your monthly expenditures and dividing that number by your monthly income.

For instance, if your bills amount to $5,000 a month and you make $7,500 a month, your DTI is 66%. It also means you are dire need of financial overhaul.

The maximum DTI to qualify for a mortgage is usually 43%. Most financial advisors recommend keeping your DTI at 30% or lower.

The median household income as estimated by the U.S. Department of Housing and Urban Development was $90,000 in 2022. That’s for a household. The median individual income in for Americans in 2022 was $56,368. Median means that half had a higher income, half had a lower income. The average American household debt load, including mortgage, is $101,915.

Year-to-year DTI statistics are hard to come by, but given the rise of debt versus the rise in income, it’s apparent that Americans in all demographic groups have higher debt-to-income ratios.

Credit Card Debt and Income

The wealthier you are, the more likely you will carry debt. Of course, the wealthier you are, the easier it is to erase that debt. The lower your income, the more of it goes to paying debt.

The median income for the top 1% in the U.S. in 2022 was $570,003; the top 10% made a median $212,110; the lowest 25% made $34,429 and the lowest 10% made $15,640.

An Annuity.org study found that, when comparing income to debt and using the $570,003 figure as 100%, the following is true:

- Those earning less than 20% paid 26.11% of income toward debt

- 20%-39% paid 11.98% of income toward debt

- 40%-59% paid 7.33% of income toward debt

- 60%-79% paid 6.45% of income toward debt

- 80%-89% paid 5.95% of income toward debt

- 90%-100% paid 4.31% of income toward debt

» Learn More: U.S. Poverty Statistics

Debt and Family Type

U.S. consumers with children have from 14%-51% more total debt than the national average, and their credit scores are lower than the national average, a study by credit reporting agency Experian found.

The study found that families with four or more children had 51% more than the national average in debt. The number decreased slightly as number of children decrease, but even one child will put a family 14% over the national average.

The study found that debt balances for credit cards and auto loans rose exponentially with the number of children. The one category in which balances didn’t increase was student loans, the premise being that by the time people are having kids, most of them are done paying for an education.

That said, everyone’s financial situation is different. The single guy next door may work 16 hours a day, have huge student loan payments and struggle to keep up with bills. The family with four kids on the other side may be high earners with wealthy backgrounds who didn’t have to take out student loans and pay off their credit card balances every month. You never know.

Though it does make sense that the more non-earning people in a home (namely, children), the more expenses the home will have. The more earning people (a couple vs. a single person), the more income there will be to pay bills and shoulder the mortgage together.

» Learn More: Financial Assistance for Single Parents

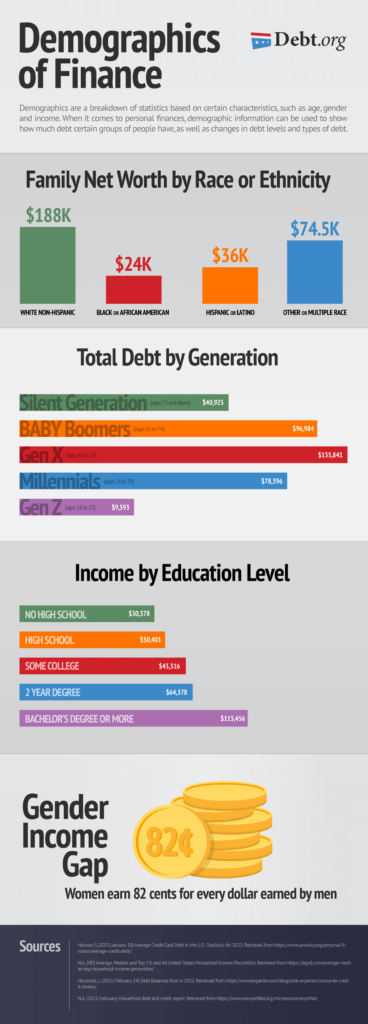

Debt and Race

Credit scores and credit history have a big impact on what’s available for American consumers to borrow, and how much that loan will cost. Numerous studies have found there are racial disparities in lending, credit reporting and scoring that end up being a catch-22 for Black and Hispanic borrowers. Having a mortgage and credit helps build a credit history that allows more favorable borrowing. If you can’t get credit, you can’t build the history.

Black and Hispanic borrowers on average have lower credit scores than white consumers, so their choices are limited. It’s even worse for Native American borrowers, who are largely credit invisible, a study by the Urban Institute found.

The average credit card balance for white families was $6,940 in 2021, the most recent figures available that break debt down by race. For Black families, it was $3,940, and for Hispanic families it was $5,510.

But the median debt-to-asset ratio for white families is 26.5%, while it was 46.8% for Black families, 46.2% for Hispanic families and 37.3% for other non-white races and ethnicities, an Employment Benefits Institute study found.

Assets include income, property and other elements that form a family’s wealth. Earlier we talked about debt-to-income ratio. Debt-to-asset ratio is similar, but also takes into account property, which can be used to enhance wealth.

A higher a debt-to-asset ratio has the same impact a lower credit score has on borrowing, meaning there are fewer options, and what’s available often is more expensive.

In 2021, the median income for white (non-Hispanic) households was $77,999, for Black households, it was $48,297; for Latino households, it was $57,981, and for Asian households it was $101,418.

Mortgages and Race

When it comes to mortgages, the median amount was $130,000 for white borrowers, $116,000 for Black borrowers and $130,000 for Hispanic borrowers, according to the Aspen Institute. The amount owed, though, doesn’t tell the whole story. Black, Latino, and Native American homeowners have mortgages that are often higher-cost and risker than those made to white borrowers, because they are based on assets, credit history and other factors. While white households borrow more heavily, they also have higher incomes, which means it’s easier to pay the larger loans, the study said.

That’s when non-white households can get a mortgage. While lenders can’t legally deny applicants on the basis of race, they use factors like credit score to deny more applications for Black, Hispanic and Native borrowers than for white borrowers, the Urban Institute found.

Student Loans and Race

Student loan debt also disproportionately affects people of color. An Investopedia analysis determined that among populations, Black, Hispanic, and Native American borrowers generally had higher unmet financial needs, incurred more student loan debt, and were more likely to struggle financially to stay in school. Black, Hispanic and Native American students most borrow more money to go to school, get less favorable rates, and owe more when they get out. As we explore later in this article, student loan debt can have a long-term impact on financial health.

Some statistics on race and student loans from educationdata.org:

- American Indian and Alaska Native student borrowers are the most likely to have payments of $350 a month or more, and pay an average $247 a month

- Black and African American student borrowers are the second-most likely to have monthly payments of $350 or more and pay an average $289 a month

- Asian student borrowers pay an average $272 a month

- White student borrowers pay an average $229 a month

- Black degree holders have an average of $27,260 in undergraduate student debt; Hispanic borrowers $25,676, Asian borrowers $25,670, white borrowers $21,578, Native American borrowers $23,343.

Debt and Gender

Women have made huge economic gains over the decades, but most have more debt than men. In 2022, women earned 82.9 cents for every dollar earned by men, according to the U.S. Bureau of Labor Statistics.

The median full-time yearly wage for men in 2022 was $61,152; for women, $50,700.

Many factors contribute to the gender wage gap, including discrimination in pay, recruitment, job assignment and promotion; lower earnings in occupations mainly done by women; and women’s disproportionate share of time spent on family care, according to the Institute for Women’s Policy Research.

Women over 65 also lag when it comes to retirement income and savings. About 50% of women ages 55-66 have no personal retirement savings, compared to 47% of men, according to the U.S. Census.

The gender wage gap has an impact on women’s debt. For instance, women and men owe a similar average in credit cards, $6,232 for women, $6,357 for men, according to Experian. Women also owe an average $192,368 for mortgages, compared to $211,034 for men.

Overall, Experian found men have more debt than women, including:

• 2% more credit card debt

• 20% more personal loan debt

• 16.3% more auto loan debt

• 9.7% more mortgage debt

But more debt doesn’t mean men’s debt burden is greater. More women report carrying unmanageable levels of debt than men (39% versus 31%), because women have lower incomes and are more often responsible for caring for children as a single parent, the Financial Health Network found. That statistic is even higher for Black women, of whom 51% report unmanageable debt.

Some 44% of women 18-29 said debt has led them to delay buying a home, getting married, having children, or making other life adjustments, as opposed to 34% of men in the same age bracket.

Women start life after college in a deeper financial hole than men, holding 58% of student loan debt. Borrowers who identify as LGBTQ also start out at a debt disadvantage, with an average of $16,000 more in student loan debt than those who do not.

Women are also more likely than men to make high monthly student loan payments despite having a lower income, and take an average of two years longer to pay off their loans, according to the National Center for Education Studies. NCES also found that women are more likely to take out loans for themselves, with parents more likely to take out student loans on behalf of a son than a daughter.

In the Financial Health Network study, 33% of women with household student debt said they are “very concerned” about their ability to pay off debt, compared with 18% of men.

Credit Card Debt

Credit card debt is one thing nearly all Americans share, regardless of race, gender or income level. It’s the most common type of debt in the U.S. By the end of 2022, Americans owed an all-time high of $986 billion on credit cards, a $130 billion increase in 12 months.

Credit limits were at an all-time high $4.39 trillion at the end of 2022, so, credit card holders still had $3.41 trillion in available credit. While that may seem like good news – consumers are using some restraint – credit card delinquencies also started to climb after dipping during the pandemic.

Credit Card Delinquency

Delinquency rates were up .06 percentage points in the last quarter of 2022. It may seem like a small amount, but it is part of a steady climb. While the number of delinquencies was lower than in 2019, there were more borrowers in delinquency at the end of 2022. Some 18.3 million people were behind on a credit card at the end of 2022 compared to 15.8 million at the end of 2019, the New York Fed reported.

While delinquency is inching up for all age groups, the rate of a credit card account transitioning into serious delinquency (90 days or more behind on payments) is particularly high for young borrowers, surpassing its pre-pandemic serious delinquency rate.

Percentage of accounts transitioning into serious delinquency in the fourth quarter of 2022:

- 18-29 age group: 7.6%

- 30-39 age group: 5.69%

- 40-49 age group: 3.81%

- 50-59 age group: 2.98%

- 60-69 age group: 2.81%

- 70 and older: 3.49%

Credit Card Balances by Age

Credit card debt is spread across all generations, with younger Americans having the smallest share of the total:

- 18-29 age group: $80 billion

- 30-39 age group: $1.9 trillion

- 40-49 age group: $2.2 trillion

- 50-59 age group: $2.2 trillion

- 60-69 age group: $1.7 trillion

- 70-plus: $1.2 trillion

Auto Loan Debt

Americans owed $1.5 trillion in auto loans at the end of 2022, an all-time high and an increase of $94 billion from the end of 2021. It’s a number that’s been going up since 2011, but has sharply increased in recent years.

The average loan increased from $17,000, in 2019 to $24,000 in the fourth quarter of 2022.

The percentage of drivers in an age group with auto loans, and average monthly payment for auto debt, according to Experian:

- Gen Z (up to age 26): 20.8% have no loan, 72.4% have one loan, 6.3% have two loans; average monthly payment is $429

- Millennials (27-42): 36.8% have no auto loan, 52.9% have one, 9.3% have two; average monthly payment is $547

- Gen X (43-58): 38.8% no auto loans, 45.9% have one, 12.6% have two; average monthly payment $637

- Baby Boomers (59-77): 49.9% no auto loan, 40.3% have one, 8.3% have two; average monthly payment, $570

- Silent Generation (age 78 and up): 65.7% no auto loan, 30.6% one loan, 3.3% two loans; average monthly payment, $477

Medical Loan Debt

There is more than $88 billion in medical debt on consumer credit reports, according to the Consumer Financial Protection Bureau. The bureau said the number is likely much higher, because there is no central reporting platform to measure the debt.

Black and Hispanic people, young adults and elderly ones, veterans and low-income Americans are more likely to have medical debt, according to the CFPB.

Medical bills that aren’t paid and go into collections and appear on a credit report will hurt the person’s access to credit, drive up prices of credit they can get and increase the likelihood of bankruptcy. A CFPB study found that 25.8% of people with medical debt reported “low or very low levels of financial well-being” related to the debt. Percentage of those with medical debt concerned about financial health, by income:

- $15,000 or less: 39.2%

- $15,000-$34,999: 40.2%

- $35,000-$49,999: 27.4%

- $50,000-$74,999: 20.4%

- $75,000-$99,999: 20.1%

- $100,000-$149,999: 15.6%

- $150,000-$199,999: 16.1%

- $200,000 and up: 22%

Student Loan Debt

Paying for college is a long-term burden for millions of Americans. Student loan debt accounted for $1.6 trillion of America’s debt load by March 2023, according to the Federal Reserve. That’s more than double what it was a decade earlier.

The average balance owed on a federal student loan is $37,574, and the average balance on a private loan is $39,590.

Some student loan debt statistics:

- 20% of American adults have undergraduate student loan debt

- 7% of American adults have postgraduate student loan debt

- 58% of adults 18-29 years have student loan debt.

- 60% of adults 30-49 have student loan debt.

- By age 30, 37% of associate degree holders and 21% of bachelor’s degree holders have been delinquent in student loan payments at least once.

Student Loans and Credit Card Debt

The more education someone has, the more overall debt they’re likely to have, because they have access to more options. But they also make more money. The highest earners have a credit card debt to income ratio of 9.1%, while lower earners are closer to 10%. People who go to college but don’t graduate and are paying student loans without the benefit of the earning power than comes with a degree have a 13.8% credit card debt-to-income ratio.

People with college degrees have an average of $8,200 in credit card debt. Those who attended college but did not graduate have $4,700, and high school only graduates have an average of $4,600, according to data from the Federal Reserve, the Consumer Financial Protection Bureau and Experian.

Student Loans and Earning Potential

A person’s education level directly affects their earning potential.

Here is the U.S. Census Bureau’s most recent look at median annual income by education level:

- No high school diploma: $30,378

- High school or equivalent: $50,401

- Some college, including associate degree: $64,378

- Bachelor’s degree or more: $115,456

In general, people who earn a degree make an average of 71% more money than peers with only high school diplomas, according to the Census Bureau.

Student Loan Forgiveness

Federal student loans were granted forbearance in 2020 because of the COVID-19 shutdown. In March 2023, the U.S. Supreme Court took up the Biden administration’s proposed loan forgiveness plan. The forbearance plan has stayed in place in the years that the forgiveness plan has been debated. If it isn’t shot down, it would cancel roughly $1 trillion in student debt, up to $50,000 per person.

The Pandemic Impact on Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020, when the unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020 — the highest level since 1948. The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt, mortgage debt and personal loan debt all went up. Credit card debt, however, dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years. Federal aid programs, mortgage forbearance, emergency rent programs and student loan forbearance all helped ease the debt load that was building.

In 2022, with emergency programs over, supply chain shortages still an issue and inflation on the rise, American debt statistics showed things had changed in two years and overall balances were $2.75 trillion higher than at the end of 2019.

Mortgage balances were $11.92 trillion at the end of 2022, a nearly $1 trillion increase in a year, with $126 billion of that non-housing balances.

Credit card balances, at $986 billion, soared past the pre-pandemic high of $927 billion.

Auto loan balances, at $1.5 trillion at the end of 2022, were up significantly from the $1.33 trillion they were at the end of 2019.

What Should You Do If You’re in Debt?

If you have debt, it’s real and has an impact on your life, it’s not just a number in the sea of American debt statistics. There are things you can do to become someone who’s eliminated debt and be part of a different consumer debt statistic pool.

Some steps you can do immediately, and on your own. Others you may need help to achieve. But no situation is impossible, and you have the power to manage and reduce, or eliminate, your debt.

Steps to take if you’re in debt are:

- Budget: It’s difficult to manage your debt unless you have a budget. It doesn’t have to be complicated, and you can use any format you want, from pen and paper to an app. Whatever you use, it should be an accurate picture of your monthly income and bills. You should reference it and adjust it often as you keep track of spending.

- Create an emergency fund: No matter how much debt you have and how bad your finances are, put $1,000 in an emergency fund so you won’t be left hanging if there’s a financial crisis while you’re attacking your debt.

- Cut expenses and downsize where possible: Your budget will reflect essential expenses, like housing, transportation, food, utilities and other things that are necessary to life. It will also show you where you can cut back. But it also may be possible to downsize and reduce debt. This could mean selling your house and moving into a rental, getting a roommate, or other housing moves. You may also be able to downsize or get rid of your vehicle, if it makes financial sense.

- Talk to your lenders: If you are in severe financial trouble, don’t ignore your lenders. Your mortgage holder, auto loan lender and credit card companies often have options and ways to work with people who can’t pay their bills.

- DIY debt reduction: You can create your own debt management plan by paying down the credit card with the highest interest rate with as high a payment as you can, while making minimum payments on your other cards. This is called the “debt snowball” method. Once that card is paid off, take the money you were aiming at it, and take on the next card. Repeat until you are debt-free.

- Talk to a credit counselor: Free counseling from a nonprofit credit counseling agency will help you no matter how much debt you have or how able you are to deal with it. The counselor will review all available debt options, from debt management plans (which have their own debt snowball methods), to debt settlement and even bankruptcy. The counselor will help you with a budget, offer financial tools and resources, and even help you resolve an issue with a credit card company. Credit counseling can be the best step you take to changing your American debt statistic profile.

Sources:

- Hanson, M. (2023, January 16) Student Loan Debt by Race. Retrieved from https://educationdata.org/student-loan-debt-by-race

- Hanson, M. (2021, December 16) Student Loan Debt by Gender. Retrieved from https://educationdata.org/student-loan-debt-by-gender

- Hanson, S. (2023, January 30) Average Credit Card Debt in the U.S.: Statistics for 2023. Retrieved from https://www.annuity.org/personal-finance/average-credit-debt/

- Haughwout, A. et al (2023, February 16) Younger Borrowers Are Struggling with Credit Card and Auto Loan Payments. Retrieved from https://www.newyorkfed.org/newsevents/news/research/2023/20230216

- Horymski, c. (2023, February 24) Debt Balances Rise in 2022. Retrieved from https://www.experian.com/blogs/ask-experian/consumer-credit-review/

- King, B. (2022, January 13) Women More Likely than Men to Have No Retirement Savings. Retrieved from https://www.census.gov/library/stories/2022/01/women-more-likely-than-men-to-have-no-retirement-savings.html

- McKay, K. et al (2022, February 7) Disparities in Debt: Why Debt is a Driver in the Racial Wealth Gap. Retrieved from https://www.aspeninstitute.org/publications/disparities-in-debt-why-debt-is-a-driver-in-the-racial-wealth-gap/

- N.A. (ND) Average, Median and Top 1% and All United States Household Income Percentiles. Retrieved from https://dqydj.com/average-median-top-household-income-percentiles/

- N.A. (2022, March 1) Medical Debt Burden in the United States. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_medical-debt-burden-in-the-united-states_report_2022-03.pdf

- N.A. (2022, December 22) Household Debt Service Payments as a Percentage of Disposable Income. Retrieved from https://fred.stlouisfed.org/series/TDSP

- N.A. (2023, January 19) Usual Weekly Earnings of Wage and Salary Works Fourth Quarter 2022. Retrieved from https://www.bls.gov/news.release/pdf/wkyeng.pdf

- N.A. (2023, February 21) How Do Supply Chain Issues Contribute to Inflation? Retrieved from https://www.usbank.com/investing/financial-perspectives/market-news/supply-chain-issues-contribution-to-inflation.html

- N.A. (2023, February) Household debt and credit report. Retrieved from https://www.newyorkfed.org/microeconomics/hhdc

- N.A. (2023, February 16) Total Household Debt Reaches $16.90 trillion in Q4 2022; Mortgage and Auto Loan Growth Slows. Retrieved from https://www.newyorkfed.org/newsevents/news/research/2023/20230216

- N.A. (2022, November 9) Income and Wealth in the United States: An Overview on Recent Data. Retrieved from https://www.pgpf.org/blog/2023/02/income-and-wealth-in-the-united-states-an-overview-of-recent-data

- Stolba, S.L. How Does Having Kids Affect Your Debt and Credit? Retrieved from https://www.experian.com/blogs/ask-experian/research/how-does-having-kids-affect-your-debt-and-credit/

- Warren, A. et al (2022, July ) The Gender Gap in Financial Health: Identifying Barriers and Opportunities for Improving Women’s Financial Health. Retrieved from https://finhealthnetwork.org/research/gender-gap-in-financial-health/

- Zinn, A. (2022, November 15) How Local Differences in Race and Place Affect Mortgage Lending. Retrieved from https://www.urban.org/urban-wire/how-local-differences-race-and-place-affect-mortgage-lending