Timeshares: Are They a Good Investment?

Home > Real Estate >

Be wary the next time you check into a resort and are offered a free gourmet dinner or a massage or Disney World tickets if you’ll just attend a 90-minute vacation seminar.

It’s a sales pitch for a timeshare.

Millions of people would tell you to rush to it and to bring your checkbook. Millions more would advise you to run for the nearest exit while you still have your wallet.

So, are timeshares a good deal or a bad deal?

The answer is B-A-D if you buy one as an investment. But if you hate to plan vacations and just want somewhere to relax, the answer is M-A-Y-B-E.

It can definitely cut back on the planning hassles. But you might find it hard to relax when the total costs start sinking in.

Basically, you are pre-paying for a vacation condo rental. But it’s like the old Roach Motel commercials – Bugs check in but they can never check out.

And you, my friend, are the bug.

Consumers started being captured in the U.S. about 50 years ago. Instead of building a resort and selling condos to single buyers, developers started selling them to multiple suckers, err, buyers.

Those folks wouldn’t have to bear the cost of a condo by themselves. They could simply buy a week in the condo every year – in effect sharing the costs and ownership with 51 other buyers.

The industry boomed as companies like Marriott, Hilton, Wyndham and Westgate Resorts jumped in. Some timeshare companies now just sell points that may be used to acquire a week or more at resorts all over the world.

It’s still a growing industry. According to 2018 United States Shared Vacation Ownership Consolidate Owners Report, 7.1% of U.S. households now own one or more timeshare weeks. That’s about 9.6 million owners or ownership groups.

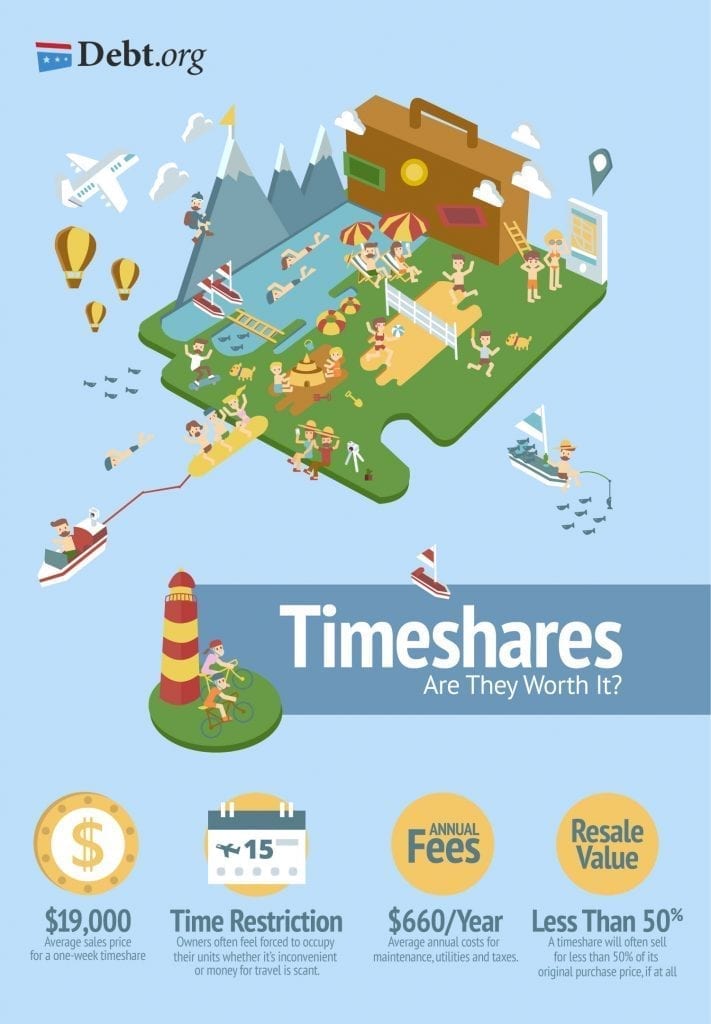

The average sales price for a one-week timeshare in 2018 was approximately $20,940, with an average annual maintenance fee of $880, according to the American Resort Development Association.

All that adds up to a $10-billion-a-year business, so timeshares are obviously doing something right. An ARDA survey found that 85% of owners are happy with their purchase.

But another study by the University of Central Florida found that 85% of buyers regret their purchase.

So which 85% would you be a part of?

Each case is different, but here are some factors to consider if you are considering buying a timeshare.

Timeshare vs. Fractional Ownership

Both types are technically “fractional,” since you own a fraction of the product. The difference is in the size of the weeks/fractions that you buy.

Most timeshares have up to 52 fractions – one for each week of the year. That means up to 52 separate owners.

Fractionals typically have only two to 12 owners. They are usually larger than timeshares and have more amenities.

Fractionals get less user traffic, so they suffer less wear and tear and are generally better maintained. And the larger the stake an owner has in a property, the more likely they are to take care of it.

Fractionals operate like homeowner’s associations. The owners retain authority and control of the property and hire a manager to run the day-to-day operations.

Timeshares are controlled by the hotel or developer, and clients are more like guests than actual owners. They have purchased only time at the property, not the property itself.

The title is held by the developer, so the purchaser’s equity does not rise or fall with the real estate market.

Timeshare owners have less control, but they also have less responsibility than fractional owners. They don’t have to pay taxes or insurance, though those costs are often rolled into the maintenance fee.

Why Timeshares Are Bad

Consumer confusion has given the industry a bad name. Most of the time you don’t know what you’re getting until it’s too late.

The timeshare industry targets vacationers who have their guards down. While relaxing on holiday, potential buyers are lured into a sales presentation for “prepaid vacations” or something that sounds similarly enticing.

Most people figure it’s a can’t-lose deal. Just sit there for 90 minutes and pick up that free dinner or tickets to Epcot.

Then the slick sales pitch begins. Before they can say “Do I really want to pay $880 in maintenance fees for a week in Pago-Pago?” the vacationers have been dazzled and walk out the proud owners of a timeshare.

Then the magic spell wears off. About 95% of clients go back to the resort sales office seeking more information, according the UCF study. But, like marriage, you can’t fully grasp the full effect of a timeshare relationship until you live it.

Many find their “prepaid vacation” is hard to schedule, has less-than-stellar facilities and is a terrible financial investment.

If they’d invested that $20,000 (the rounded average cost of a timeshare) and gotten a 5% return compounded annually, they’d have $32,578 after 10 years.

Instead, they have a condo that has plummeted in value and nobody wants to buy. Of course, you have to balance that against the cost of a yearly stay in a regular hotel or vacation rental.

But you can find a decent hotel for $200 a night. That will probably be cheaper than what you’re paying for a timeshare, and you’d also have flexibility to vacation anytime and anywhere you want.

To millions of consumers, that’s not as important as the joy and stability of a timeshare. If they feel a like winner in the deal, they are.

The real winner is the developer when it persuades 52 buyers to plunk down $20,000. That adds up to $1,040,000 for a condo that would probably be worth $250,000 on the open market.

No wonder they give you a free dinner.

How Can You Get Out of a Timeshare?

Let’s just say it’s a lot easier to get in than get out. A timeshare typically comes with perpetuity clauses, meaning it is yours forever.

And after you die, it belongs to your heirs. On it goes until the sun burns out in 4 billion years, at which time the developer might let your heirs off the hook.

Actually, it’s not quite that bad. But it’s close.

Most timeshare contracts don’t allow “voluntary surrender.” That means if the owner gets tired of it or their heirs don’t want it, they can’t even give it back to the developer for free.

Even if the timeshare is paid for, developers want to keep collecting that hefty annual maintenance fee. They also know the chances of finding another buyer are pretty slim.

When it comes to the resale market, you’re better of trying to re-sell a Christmas fruitcake than a timeshare. It’s not unusual to find them listed for $1 on eBay, which shows how desperate some owners are to escape their prepaid vacations.

If you’re willing to give it away, how do you persuade the developer to take it?

You can play hardball, stop paying the maintenance fee and enter foreclosure. That means legal expenses for the developer, so there’s a chance they’ll let you out of your contract.

There’s also a chance they won’t and they’ll turn your account over to a collection agency. That will damage your credit score.

If you hate confrontation, you could hire an attorney. But basically you’d be paying someone to handle the dirty work you could do.

There’s such a demand to escape timeshares that it’s spawned an entire sub-industry of “exit companies.” Some are reputable but many are timeshare scams. The Florida attorney general received 450 complaints about exit companies in 2018, according to the Orlando Sentinel.

Red flags to look for are large upfront fees (sometimes more than $15,000) and guarantees you’ll get out of your contract.

On the plus side, the rise of exit companies has helped force developers to be more willing to let owners off the hook.

Overall, however, many timeshare owners end up talking like people who buy boats. The second-happiest day of their life is when they buy it. The happiest day is when they sell it.

Alternatives to Buying a Timeshare

If you don’t mind spending vacations in the same place, buying a vacation home or condo is a far better investment than a timeshare.

The rub there is being able to afford such a purchase. If it’s not in your budget, resort memberships and condo hotels might work for you.

A resort membership requires a one-time payment for access to a resort. Upfront fees vary, but you can get five-year memberships for as low as $2,000 or lifetime memberships for $3,000.

You won’t be responsible for maintenance fees or taxes, though some memberships have yearly fees. Members can also choose from other vacation spots in the resort company’s network, and the dates are far more flexible than with a timeshare.

With a condo hotel, you buy a unit in a luxury hotel. It’s different than simply buying a condo in that the developer is in charge of renting it out when you’re not there and takes a cut of the proceeds.

A condo hotel unit will cost as much or more than buying a regular condo. The upside is that there is a perpetual glut of condos on the market, while condo hotels are a relatively new concept.

Most are operated by big-name companies like Ritz-Carlton, Hilton and, yes, Trump. They offer the same high-end services, which can be a big selling point.

Conclusion

So, good deal or bad deal?

The answer depends on the individual. But nobody should be in a hurry to sign on the dotted line.

The sales pitch will be long on promises but short on transparency. And it’s never advisable to make a significant financial decision while you’re sipping a vacation margarita.

There’s a massive resale market for timeshares. You might be able to pick one up for pennies on the original buyer’s dollar. If all goes well, you and your timeshare might live happily ever after.

So take your time and do your research. And if you’re on vacation and somebody offers you free tickets to Disney World if you’ll attend a sales presentation, just tell them you are allergic to Mickey Mouse.

Sources:

- Wyndham Vacation Ownership. (n.d.). All About Timeshares. Retrieved January 2, 2013, from http://www.timeshares.com/ts/all_about_timeshares/index.go

- Timeshare Pros and Cons. (n.d.). Redweek.com. Retrieved January 2, 2013, from http://www.redweek.com/resources/articles/timeshare-pros-and-cons

- Nelson, S. (n.d.). Timesharing 101 - A TUG Introduction to Timesharing. The Timeshare Users Group. Retrieved January 2, 2013, from http://tug2.net/timeshare_advice/timesharing_101_an_introduction_to_timeshares.html

- The Federal Trade Commission. (n.d.). Timeshares and Vacation Plans. Retrieved January 2, 2013, from http://www.consumer.ftc.gov/articles/0073-timeshares-and-vacation-plans

- Grabianowski, E. (n.d.). How Timeshares Work. Retrieved January 2, 2013, from http://adventure.howstuffworks.com/timeshare1.htm

- Scambusters.org. (n.d.). Timeshare Scams. Retrieved January 2, 2013, from http://www.scambusters.org/timeshare.html

- Ramsey, D. (2009, May 27). The Truth About Timeshares. Retrieved from http://www.daveramsey.com/article/the-truth-about-timeshares/

- Strain, J. (2007, February 24). 10 Reasons Timeshares Are A Bad Deal. Personal Finance Advice. Retrieved from http://www.pfadvice.com/2007/02/24/10-reasons-timeshares-suck/

- Brenoff, A. (2010, May 18). Timeshare Bargains Abound, but are They Really Bargains? Daily Finance. Retrieved from http://www.dailyfinance.com/2010/05/18/timeshare-bargains-abound-but-are-they-really-bargains/

- Bortz, D. (2012, July 19). Should You Invest in a Timeshare? U.S. News & World Report. Retrieved from http://money.usnews.com/money/personal-finance/articles/2012/07/19/should-you-invest-in-a-timeshare

- Schreier, A. (n.d.). 7 Timeshare Tips Every Consumer Should Know. About.com/Senior Living. Retrieved January 2, 2013, from http://seniorliving.about.com/od/entertainmentrecreation/a/timeshare_tips.htm